|

Adriatic Metals announced on the 11/5/2020 that they had reached an agreement to acquire Tethyan Resources, a Serbia focused explorer, in an all-stock deal in exchange for 6.9% of the company. Adriatic appears to be focused primarily on the brownfield Serbian assets, Kizevak and Sastavci.

There are very similar historical parallels between the Raska district and Vares as a locality where Adriatic have their present operations. The Raska district has a long history as a mining region. The Kizevak and Sastavci mines were discovered in the mid-1970s and operated by the Yugoslav geological survey between 1984 and 2000 when mining ceased due to the Balkans conflict. The projects benefit from numerous infrastructure advantages including water, power, road and rail access all within 5 kilometres, and a local workforce with a long history of mining. No significant exploration work has been conducted on either licence since mining ceased, and the projects offer significant exploration potential for the expansion of existing mineralisation along strike and down dip from the open pits at Kizevak and Sastavci. The historical deposits have been untouched by modern exploration techniques. Interestingly, Tethyan has historically only been able to explore the areas surrounding the historical mines as it did not hold the ground containing the historical mines. However, this ground has now been acquired as part of the Adriatic transaction and only a relatively small amount of drilling needs to be done to confirm continuity between the historical mineralisation and the mineralisation encountered by Tethyan. We note that the deposit appears to be very shallow, with very little exploration at depth with historical cores that have not been tested for precious metals. Adriatic have proven they can add value via interpretation of historical cores and follow up exploration drilling on the brownfield assets given their experience at Veovaca and Rupice. They have also demonstrated their ability to progress projects at extraordinarily fast pace delivering a Scoping study/PEA for the Vares Project within 2 years of their ASX listing and are on track to deliver a DFS within the next 7 months. We believe that Adriatic's management team can add significant value to the Serbian assets being acquired by the end of the calendar year. The acquisition firmly positions Adriatic as the pre-eminent Balkan polymetallic developer, whilst providing a longer-term development pipeline over and above the existing Vares Project. The acquisition provides an existing in-country team and relationships, whilst also providing the advantage of jurisdictional diversity to both sets of shareholders. Adriatic have stated that they intend on delivering a Maiden JORC resource estimate for Kizevak and Sastavci before the end of the calendar year 2020. Assuming a small uplift on the existing non-JORC deposits, we anticipate that between 8-10 million tonnes of ore could be delineated at grades between 6-9% Zn equivalent. Adriatic aim to deliver a PFS for the acquired assets by the end of the calendar year 2021, with permitting likely to occur in conjunction with feasibility studies. Overall, we consider this an acquisition that may prove to be extremely value accretive for Adriatic shareholders. We think the timing of the transaction at a cyclical and covid-affected low was strategically sound and well-executed. Our thesis is that the seeds of a base metal boom are being sown in the current market duress with many marginal, higher-cost mines being shut down; however, this dynamic will take time to play out. We believe that it's quite likely within the next 2-3 years, base metal prices will be considerably higher; leaving Adriatic well-positioned and strongly leveraged to a recovery in base metal spot prices. Disclaimer: This article does not take into account your investment objectives, particular needs or financial situation; and should not be construed as advice in any way. The author holds shares in Adriatic Metals (ADT). Self Wealth (SWF) is a platform with a unique product offering that offers flat-price online broking and ancillary services.At present there are 4 separate revenue streams:

There is significant scope for additional revenue streams to be developed at very low incremental cost that will become increasingly more valuable as the user base grows; we have made suggestions to the management team and it is to be seen whether these will be pursued. The company also has a number of significant organic growth opportunities within its current product lines: International trading, multiple trading account functionality and a new mobile app are all in development and have the potential to further increase the company's rate of growth in the near term.The strength of the self wealth model is its low touch, automated, highly scalable approach. Prior to the COVID19 curfews, it was growing strongly year on year: having grown all key metrics by more than 100% between January 2019 and January 2020. The effect of current curfews has been like pouring petrol onto an already roaring fire. In the most recent March quarter vs the December quarter: Trade volume grew over 100%, Client cash held grew over 150% and active users grew by almost 50% (achieving almost 70% of their previous annual growth target in 3 months). We believe this growth cannot be looked at in isolation but is a validation of the structural shift we see in the local online broking markets. Self Wealth is unequivocally the lowest cost provider in the market providing a large incentive for new users to try the service; this consequently leads to increased client 'stickiness'. The platform is very stable and in the recent market volatility, outperformed it's larger competitors (Commsec and Nabtrade) in terms of uptime. We note that market trade volumes are correlated with overall market volatility, meaning that Self Wealth may benefit from the higher than usual levels of market volatility. It is clear that Self Wealth has been profitable since the month of March and we expect this to continue going forward. Our information gathering suggests that April may very well be another record month of growth for the company. The increasing scale of the company's operations will lead to a fall in incremental costs. Our internal growth model suggests a base case EBIT projection for FY21 of ~$6.5 million; with our upper case scenario being multiples of the base case. Currently trading at an undemanding $45 million market cap, this represents a forward projected EBIT multiple of only 7x. This is an excerpt of Datt Capital's comprehensive research note on Self Wealth. To request a full copy please follow THIS LINK Disclaimer: This article does not take into account your investment objectives, particular needs or financial situation; and should not be construed as advice in any way. The author holds shares in SWF. The biggest investment risk today for investors is to be underweight equities. The ASX Total Return Index as at the end of March, was down approximately 27% from it's January highs. This means for an investor who bought the high and held through the volatility, they would need to achieve a 37% return from the end of March to breakeven.

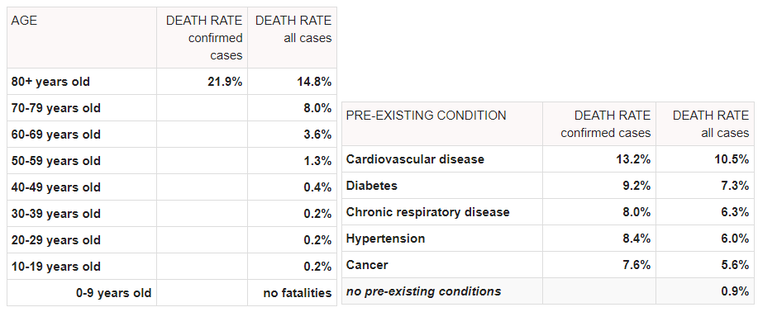

According to the Credit Suisse Global Investment Returns Yearbook 2020, Australia has been the highest equity returns in global markets on average since 1900. Achieving a 7% real return calculated in US dollars, compounded over a long time frame is not something that can be ignored by any investor, local or global. It is a testament to our relatively stable political environment, our natural resource endowment and our growing population; all of which bodes well for potential future returns. Focusing on the present situation, we are clearly in an inflationary environment with widespread monetary and fiscal stimulus and support being provided by governments worldwide. In an inflationary environment, stocks are the only listed asset class that will provide a positive real rate of return; bonds and hybrids are vulnerable to the achievement of future negative real returns given interest rates are at their lowest rates in history. If you are a large investor who has been invested across asset classes, you have effectively have been made whole by the Australian government if you have had investments in local bonds and have sold. The next question in this instance would be: where to store your wealth to ensure it retains its purchasing power whilst achieving a nominal real rate of return? Virtually all fund managers are cautious and under-invested holding larger than usual cash weightings. As we've seen in the past, the majority are usually wrong in a risk-off environment filled with the perception of uncertainty. If the market continues to grind higher it increases the risk of manager under-performance and consequent pressure from investors to increase market exposure to invest at higher equity values. Another aspect to look at is could there be any news worse than what has transpired over the past 2 months? There is now significant data around the treatment and prevention of COVID-19. We know almost unequivocally that the elderly and obese with pre-existing conditions are highly susceptible whilst younger, healthy individuals have a relatively benign response to the virus. We believe that it's unlikely that COVID-19 will ever be fully eliminated for reasons beyond the scope of this article. We expect societal restraints to be relaxed sooner than later, with higher risk individuals maintaining quarantine. The government can mitigate the impact of vast social issues that are arising from an extended lockdown by loosening current restraints. Behavioural changes don't need to be mandated to be followed, for instance, the past impact of SARS affected social behaviour in the hardest-hit nations leading the widespread voluntary adoption of wearing face masks in public. Over the past 2 weeks, we have been selectively increasing our equity weighting with a focus on quality. Markets always move in anticipation of change and the seeds of every bull market are sown in times of uncertainty. We discuss 3 of our new positions in a recent podcast which can be found here: https://bit.ly/Datt-Media Disclaimer: This article does not take into account your investment objectives, particular needs or financial situation; and should not be construed as advice in any way Emanuel recently was interviewed by two of Australia's best known financial podcasters, Alan Kohler and Owen "Rask" Raszkiewicz.

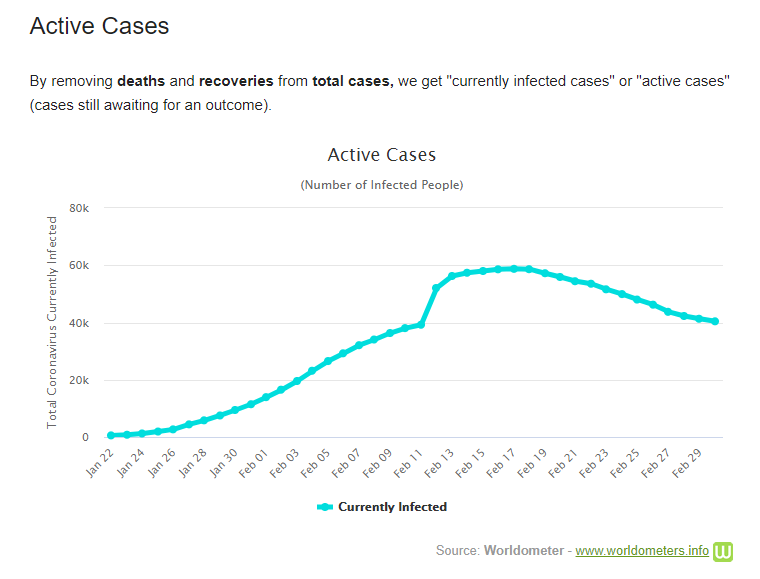

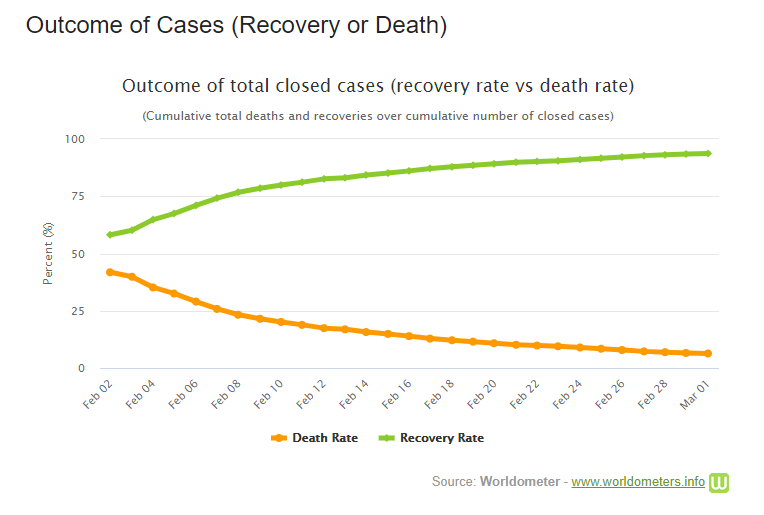

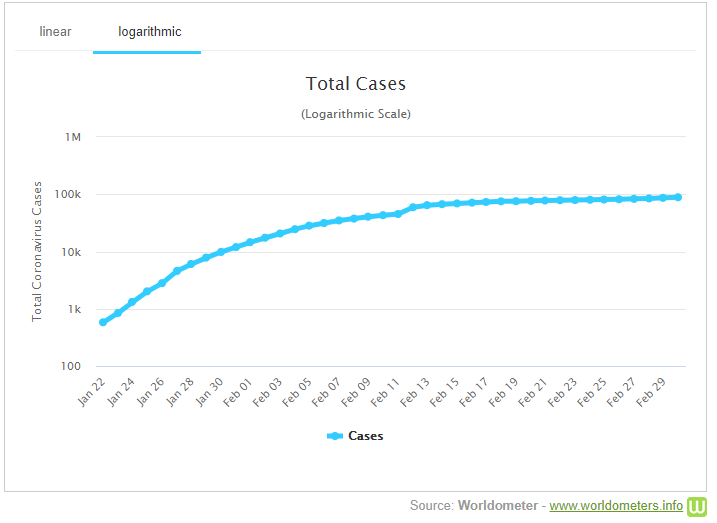

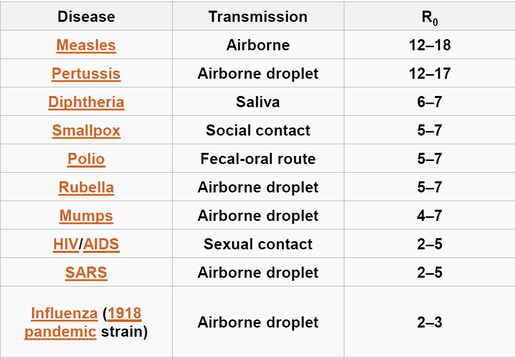

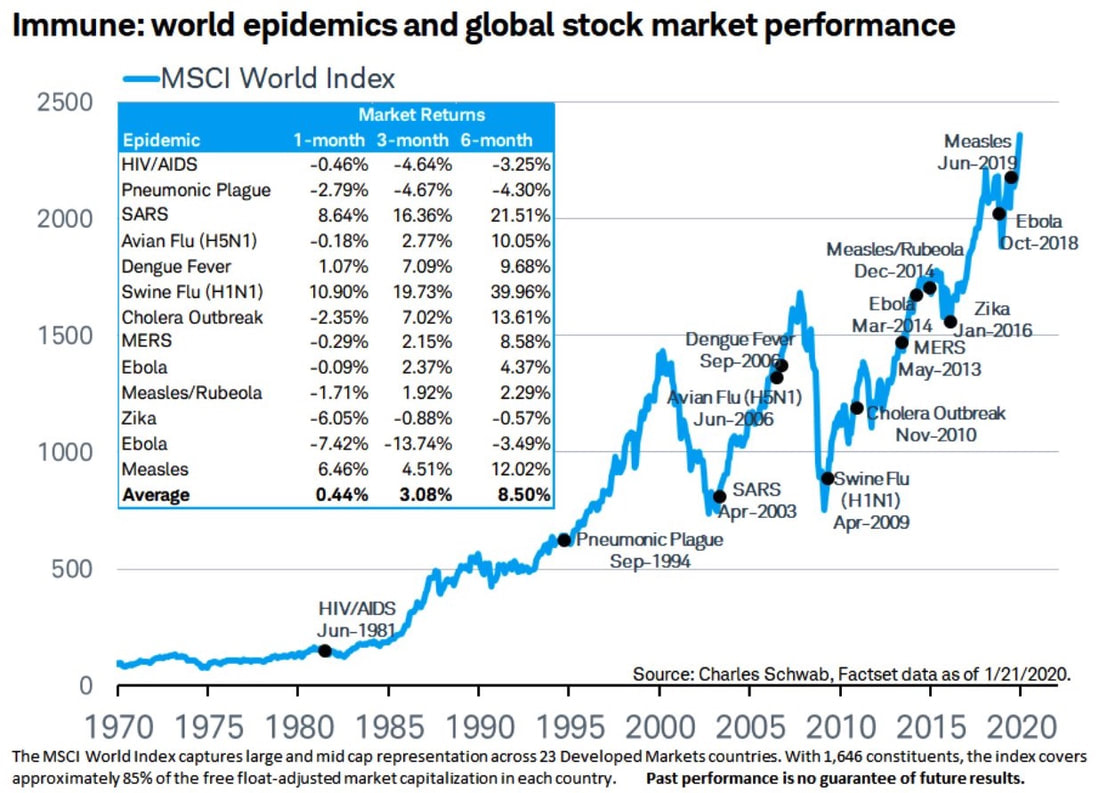

The links for both interviews can be found via the following links: Alan Kohler - "A barbell approach to investing" (subscriber only) - https://bit.ly/Datt-Kohler Owen Rask - "Stock Pick: Emanuel Datt | Datt Capital" - https://bit.ly/Datt-Rask2 We are finding many attractive opportunities to deploy capital in this market, in companies both large and small. This 'risk-off' environment has thrown up a variety of bargains which we have started to selectively invest in, this may be an opportune time to consider an investment into the Fund. Investors and potential investors should be aware that performance fees will only be applicable should we achieve a return of approximately 25% above the Fund's current net asset value; whilst reiterating that we are the Fund's largest investor providing direct alignment with other investors. We welcome any enquiries which can be lodged via this link: https://bit.ly/Datt-Investor At present, there have been approximately 90,000 cases of clinically confirmed SARS-CoV-2 ('Coronavirus'). We estimate that there have been potentially double this number who have been afflicted by the virus but have not reported due to recoveries. There have been approximately 3,000 deaths and 45,000 recoveries, with approximately 42,000 active cases worldwide. Interestingly, the number of active cases worldwide is trending down despite the virus spreading geographically. Also, the recovery rate vs death rate is trending strongly up implying that medical professionals are becoming increasingly successful at treating the condition. Despite some expressing fearful, dystopian views over social and mass media, the actual growth of total cases is not exponential and appears to be flatlining in absolute terms. As can be expected, older individuals who have pre-existing health conditions are at higher risk of death from the virus. Much of the rhetoric has been around the rate of spread, or the average number of secondary cases arising from a primary case (R0 value). It is estimated that the R0 value for Coronavirus is between 2 & 3. Whilst prima facie, this appears to be high, especially when compounded, it is a small value relative to some other previously common diseases. Other factors that may determine how prevalent the virus becomes in a nation also include cultural factors as social customs - 'kissing cultures' as generally practiced in Italy and Iran have proven susceptible. Population density, public sanitation, and hygiene will also be large factors in the spread of the virus. Whilst general fears exist that the Coronavirus may become as prevalent as the Spanish Flu pandemic of 1918, we do not necessarily believe this hypothesis given there are several key differences in circumstances. Most prominent is the fact that modern sanitation and hygiene were still in their infancy during this period in the Western world, as well as the fact that the first World War led to greater densities of people in close quarters most who would have been geographically mobile. We are beginning to see green shoots out of the chaos. Our monitoring of traffic data from Chinese cities demonstrates an uptick in traffic volume over the past week relative to prior weeks; albeit at still depressed levels. Wuhan at the epicenter of the epidemic is currently experiencing traffic volume about 20% of average; whilst cities further afield appear to be slowly trending back towards their annual averages. We expect traffic volumes to recover fully in a month or two. We are also encouraged by historical data relating to periods immediately post an epidemic, with an average 6-month return of around +8.5%. Our evaluation of the data behind the Coronavirus outbreak along with the emergence of some attractive market opportunities leaves us with a positive sense regarding the medium-term market outlook.

Disclaimer: This article does not take into account your investment objectives, particular needs or financial situation; and should not be construed as advice in any way. Alkane yesterday confirmed another strike of 689 metres @ 0.46g/t gold, 0.19% copper from 402 metres depth from the Boda prospect, stepping out a further 100 metres to the east. This followed up on the initial discovery strike of 502 metres @ 0.48g/t gold, 0.20% copper from 211 metres depth.

We consider this a fantastic intercept, clearly demonstrating consistency and the continuation of grade at depth. We believe the latest result is high quality, having spatially explored a different plane to the discovery hole by apparently skewing to the north. As such we believe the odds of confirming a large scale porphyry system have shortened significantly. Alkane has disclosed that another 2 holes to the south will be drilling along with another to the north, all at 100-metre step-outs. We expect that given the scale and nature of the recent strike, this program will be materially expanded and we expect to see multiple drill rigs on site for the foreseeable future. Should Alkane confirm sufficient tonnage and grade at Boda, we believe that the deposit will be extraordinarily valuable for several reasons. Most important is the location: in a safe jurisdiction, on flat open grassland, only a 4-hour drive from Sydney and 30 minutes from Dubbo providing a readily available skilled labour force. The economics of mining large mineral deposits in NSW are very well understood given the various operations at Cadia, Northparkes and Cowal. The key levers of any mining operation are: capital intensity, political risk, ore grade, operating cost and byproduct credit value. From our perspective, Boda's geographic location alleviates many of these levers, with of course the scale and ore grade of the deposit still needing to be confirmed by further drilling. Even though it is still early in the exploration process, there is no doubt that this project would have the attention of all the large Australian miners; BHP, Rio Tinto and Newcrest all who are desperate to increase their exposure to Tier 1 projects on their home turf. The economic potential of large disseminated ore bodies is generally not well understood by Australian investors, which is to their detriment. Alkane are in the truly fortunate position of being able to largely self-fund exploration at this stage, due to their gold production assets at Tomingley. Tomingley itself has good growth potential with cumulative exploration targets of approximately 2 million ounces on their ground. If successful, this would materially increase the life of mine operations at Tomingley to a range of 10-20 years depending on exploration success. Whilst this is a very handy resource, it is dwarfed by the exploration potential at Boda. Boda deposit and district-scale exploration potentialAt Boda, Alkane appears to have found the extent of mineralisation to the west, however, they still have not found the high-grade core of the porphyry which provides an indication of how truly significant this deposit may be in time. The current results have effectively only scratched the 'halo' of the porphyry itself. We speculate this high-grade core lies further to the east at depth. Mineralisation remains open along strike (north-south), at depth and to the east. We note that porphyry districts usually contain multiple, clustered deposits, typified by the Cadia complex which contains 5 separate ore bodies. We expect that other deposits may be found in time within a 3-5 km radius of Boda. We consider the 100m interval step out drilling being conducted to be fairly low risk, considering the number of shallow but low-grade historical strikes. Alkane suggests that the style of alteration and mineralisation at Boda has several apparent similarities as Newcrest's giant Cadia East deposit (2.9 billion tonnes @ 0.36g/t gold, 0.26% copper), including equivalent grade. We note that in the early stages of the Cadia East deposit, the first 4 successful holes were relatively low grade; it was only once exploration was conducted at depth to the east that the high-grade core was discovered. West North West (WNW) is an extremely important direction in NSW resources, the Cadia deposits and other major mineralised faults broadly follow this angle. We feel this is replicated by the geometry of the Kaiser-Boda complex with further exploration potential along the Belgian and Sullivan faults which runs towards the south-east. Also, we note that Cadia East and Boda both begin from approximately 200m depth. Our analysis and review of the historical drilling by Alkane and others in the area leads us to the conclusion that it is likely that Boda is already a substantial deposit in its own right. Mineralised intercepts have already been recorded for at least 500 metres of north-south strike, at least 450m in width east-west and at least 800 metres in depth. Whilst this still needs to be confirmed via step-out drilling, we believe there is clear evidence for a large ore body existing at depth. There is very strong evidence for district-scale exploration potential evidenced by the purchase of an exploration block by Alkane from Impact minerals for $100,000 mid last year; immediately to the south of Boda. Alice Queen holds the ground only 600 metres east of the latest Boda drill collar with various faulted structures, most prominent being the Belgian and Sullivan faults, running directly into Alice Queen's large tenement that has never been tested. This ground at Boda East must surely be the hottest exploration ground in Australia, especially considering that Alkane appears to have found the western extent of Boda's mineralisation. Our research suggests the average width of commercial porphyry deposits to be over 1 km, with multiple deposits clustering within a radius of 3-5 kms. We also note that should Boda prove to hold a commercially viable deposit, it is highly likely that any mining lease application would have to extend into Alice Queen's ground given the nature of cave mining, making this an extremely strategic and valuable parcel of land. Alice Queen we expect will be very interested in Alkane's results going forward in addition to their exploration works on the other side of the fence. The company controls the entire northern part of the Molong Belt, a large area of approximately 700 square kms. There is no doubt that Alkane among others are observing the efforts of their junior neighbors to the east. Dubbo Project - Australian Strategic Minerals The Dubbo Project is one of the world's largest and advanced rare earth projects that are in pre-development. The current large resource supports an open pit mine life of over 70 years making this a strategic and valuable asset, especially considering the anticipated rise in demand for rare earth products over the next 10 years. The project has been fully permitted and front end engineering studies completed; along with completed feasibility studies that have been kept current by the company. The feasibility study was conducted on an initial 20-year base case operation scenario, which provided an NPV of $1.24 billion, however, with a large initial capital outlay of $1.3 billion. There have been further studies conducted to reduce this figure including a staged, modular design as well as more recently some very promising Korean technology that has the potential to materially reduce the capital expenditure and operational costs of the project. We feel there is potential to materially improve the project's projected financial metrics in the case of success for these various initiatives. We note the recent appointment of an MD for Australian Strategic Minerals and that a decision will be made before the end of the financial year to demerge or spinoff this project into a separate ASX listed vehicle. Should the demerger go ahead, we expect Alkane shareholders will receive shares in the new listed vehicle in proportion to their shareholding, an attractive proposition considering most spinoffs are value accretive to shareholders and the strong industry fundamentals. We consider Alkane to be an outstanding investment proposition given its exposure to 3 unique projects, all which have the potential to add material value over the coming months. Disclaimer: This article does not take into account your investment objectives, particular needs or financial situation; and should not be construed as advice in any way. The author holds shares in ALK & AQX. Alkane Resources is a gold producer with outstanding gold-copper exploration potential as well as holding an undeveloped rare earth project, which is anticipated to be demerged at some stage this year.

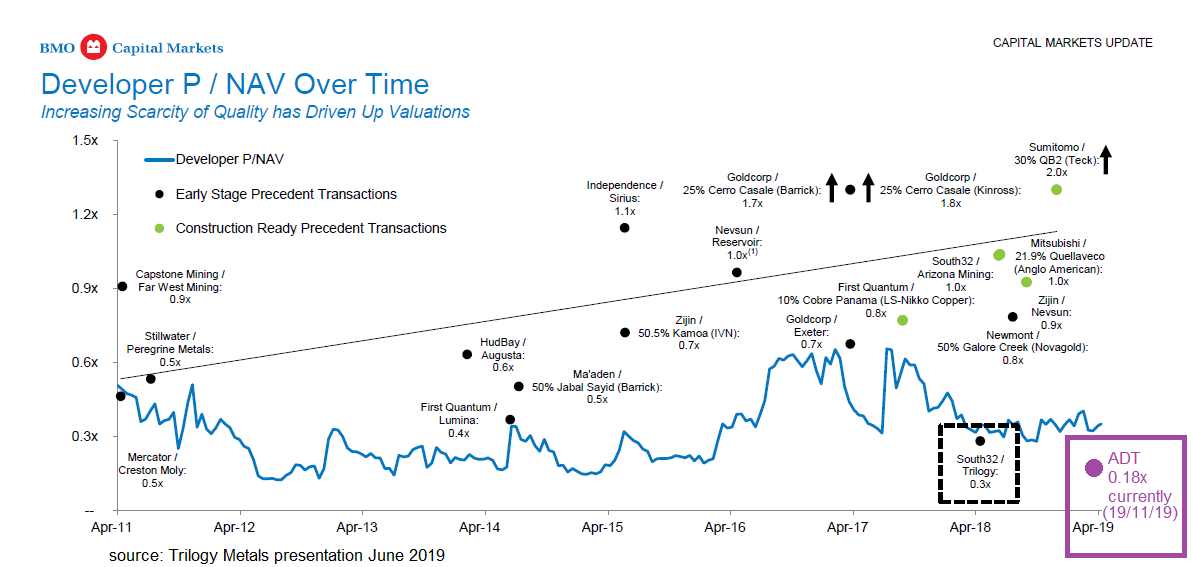

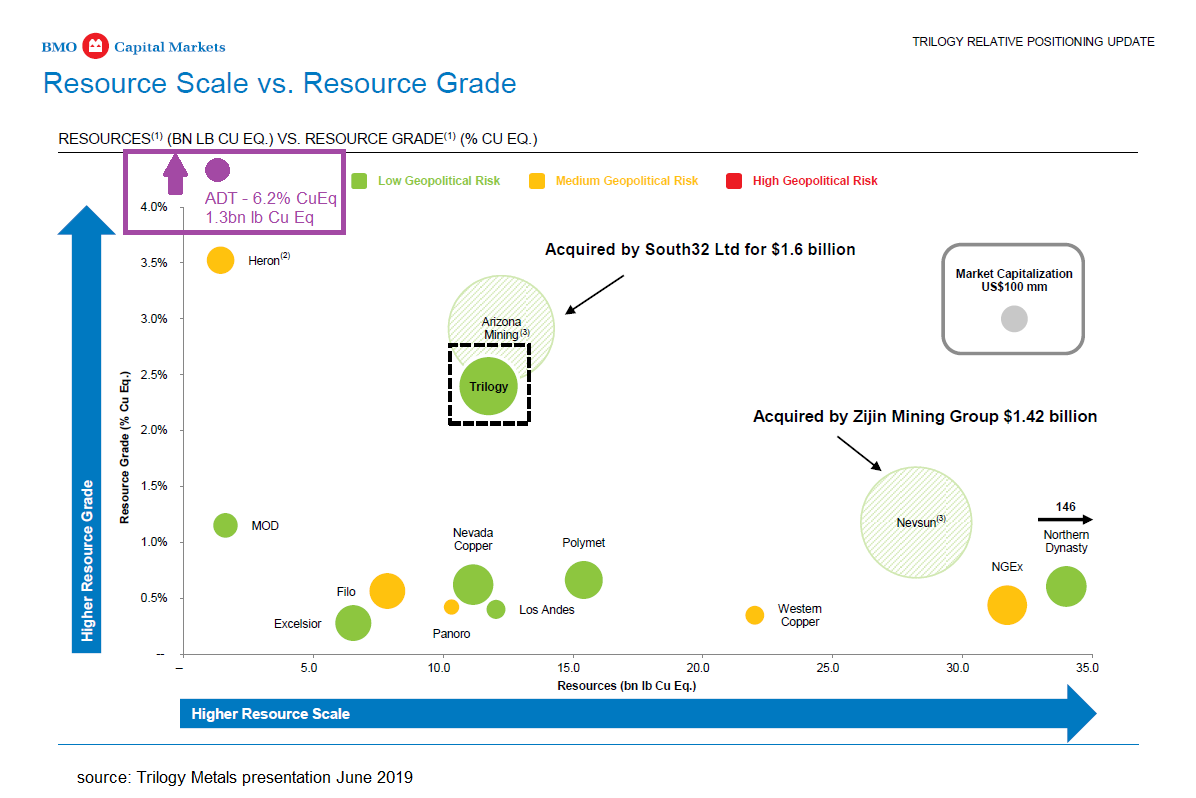

Alkane's recent discovery strike at Boda was the best porphyry exploration discovery hole in the Lachlan Fold Belt outside the Cadia, Cowal and North Parkes mines in the last 20 years; according to John Holliday, the discoverer of the world-class Cadia deposit and a technical consultant to Alice Queen (another portfolio holding). The discovery strike of 502m @ 0.48g/t Au, 0.20% Cu from 211 metres in depth, ended in strong mineralisation to the end of hole. We believe this is exceptionally significant. The strike is exceptionally gold rich relative to other porphyry deposits, and we are encouraged by the fact that the copper grade appears to increase at depth. Importantly, a clear high-grade zone of approximately 361m of over 1g/t exists between 228m and 589m intervals. To put it into context, this high grade zone of strike was superior to the Cadia Hill discovery hole which struck 243m @ 1.21g/t Au; and superior to the current reserve grade at Cadia East. A lot more work needs to be conducted by Alkane to prove that a large deposit exists, but the potential for a large, commercial discovery is clear. Alkane are currently waiting on assays from a second, deeper hole being drilled 100 metres to the east of the initial strike, to test at a planned depth of 1100 metres. An additional 4 holes are planned for the current exploration program however, we expect the number of metres drilled to increase significantly in the case of step out holes at Boda. Large porphyry deposits are generally clustered, typified by the monstrous Cadia-Ridgeway complex which spans almost 20 sq km and enjoys a rich mineral endowment of 38 Mozs of Au & 8.3 Mt of Cu. We note that mineralisation at the Cadia complex, broadly runs in an east-west direction for approximately 7kms. With Alice Queen’s Yarindury tenement only 700 metres away from Boda's discovery hole, we believe that there is very strong potential that the mineralisation that Alkane discovered at Boda, may extend onto the Yarindury tenement. Accordingly, our portfolio has significant exposure and leverage to the outcome of another successful hole at Boda. Alkane also possess an operating 1 mtpa plant at its Tomingley gold project, currently producing around 30,000 ozs of gold per annum. We expect production to increase over time as higher grade ore is mined, along with further definition of resources at Rosewell, San Antonio and El Paso; which will increase the life of mine significantly for the project. We believe the upcoming demerger decision for the Dubbo rare earth project will also be a key catalyst for the company, and has the potential to significantly rerate the stock on the basis of its ‘pure’ gold-copper exposure. We consider Alkane to be a compelling investment proposition, given the numerous near term catalysts on the horizon. Disclaimer: This article does not take into account your investment objectives, particular needs or financial situation; and should not be construed as advice in any way. The author holds shares in ALK & AQX. This is an addendum to our investment thesis released on Adriatic Metals ('ADT'). We have been requested by several investors to share our research on similar projects as Vares. We have found that the overall quality of the Rupice deposit has been largely overshadowed by the perception of Bosnia as a mining jurisdiction. We hope this brief comparison will demonstrate the utter uniqueness of the still-growing Rupice deposit relative to other base metal peers. Base metal projects are often converted to copper equivalent (CuEq) to provide a simple method to compare different deposits, especially in the case of polymetallic deposits. ADT has not provided CuEq figures, most likely as the Vares project deposits are copper poor; and have used gold and zinc equivalents (AuEq, ZnEq) as a proxy. We thought it would be beneficial to convert the resource to CuEq just to provide a broad economic comparison relative to other projects. Accordingly, for the Rupice deposit, we come up with an approximate CuEq of ~6.2%. This includes the contribution of barite and takes into account the preliminary met recoveries disclosed by the company. We should note that 'equivalent' grades should never be used solely as the basis for an investment decision by investors, and more detailed analysis should be conducted. The following comparison charts demonstrate how unique and undervalued ADT is relative to comparable base metal projects. It is extremely rare for a resource project to possess an IRR >100%, an NPV above AUD$1 billion and a payback period of less than 12 months. There is a material shortage of commercial base metal development projects available. This is largely due to the exploration decline post-2012 and a continuing skew towards gold relative to base metals in terms of exploration spend. The overall quality of new base metal has fallen dramatically over time, as many high grade and close to the surface deposits have already been discovered.

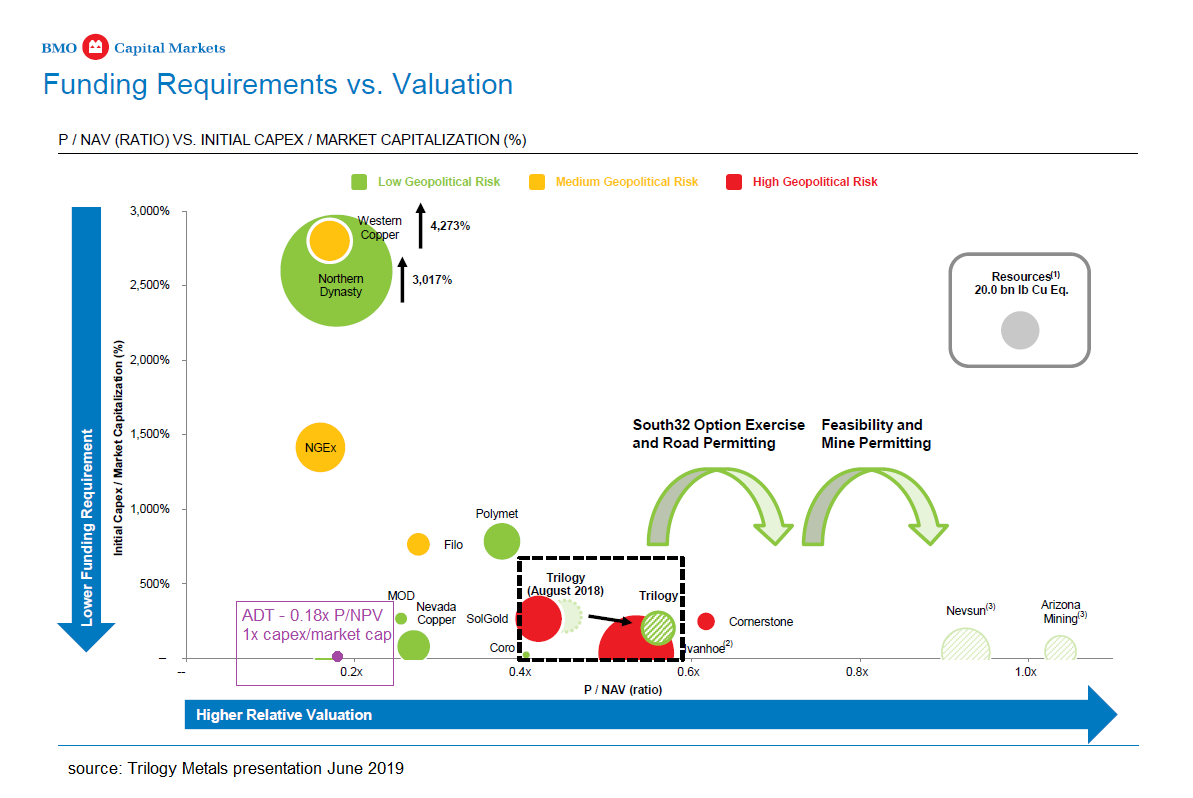

What's it worth? We examined a peer group of approximately 25 undeveloped resource projects globally and noted the following: Unfinanced projects on average trade at circa 30% of NPV. We believe that ADT should at minimum, trade at the peer group average. Financed projects on average trade at circa 55% of NPV. We believe that ADT should trade at a premium to the peer group average as they advance through the permitting, feasibility and initial financing processes which we believe will occur over the next 12 months. ADT is without a doubt, the standout base metal project in terms of IRR, NPV, capital efficiency, and other economic metrics. What happens now? ADT possesses a unique resource of almost unparalleled quality which drives the projects exceptional potential economic returns along with a very favourable cost jurisdiction. Over the next 12 months, we expect the company to continue to build upon the initial resource at Rupice as well as further explore brownfield and greenfield prospects selectively. We also believe that within this time frame that the company should complete a detailed feasibility study as well as completing the permits required for the mining and processing operations. We should add that any further discoveries or extensions in the project life will only increase already exceptional returns. We also note that the upcoming LSE listing will broaden ADT's investor base and likely provide another potential catalyst for the stock to rerate. Disclaimer: This article does not take into account your investment objectives, particular needs or financial situation; and should not be construed as advice in any way. The author holds shares in ADT. Adriatic Metals ('ADT') are a base metal developer in Bosnia & Herzegovina (BiH), with a world-class resource in a global scale mineral province.

The breakup of Yugoslavia and the consequent Bosnian war, along with high upfront costs for mining concessions has largely preserved the exploration opportunity in BiH despite a long, proud history of mining. As such, the area has barely been touched by modern exploration techniques which bode well given its geographic and geological locality. The team at ADT recognised the significant opportunity at hand and managed to secure a portfolio of high-quality assets via its first-mover advantage; it is still the only listed resource company globally with operations in the BiH. The BiH is a stable, democratic nation with a favourable regulatory environment and supportive of mining. Foreign investors possess the same rights as locals, tax and royalty rates are very attractive and the costs of operating are extremely low. Serbia, which borders Bosnia, has attracted significant investment from a multitude of mining majors in a similar geological setting. ADT's founders discovered a warehouse of Yugoslav era technical reports dating back 30 years, providing valuable information on historical brownfield projects and exploration activities that allowed it to grasp the low hanging fruit in terms of prospectivity. Consequently, the company has made a world-class, poly-metallic greenfield discovery in Rupice (9.4mt @10.1 g/t Au equivalent) along with significantly advancing a brownfield asset in Veovaca, collectively referred to as the Vares project. As a result, ADT was the ASX's best performing IPO in 2018. We believe the potential for further quality discoveries is high given the lack of systematic, modern exploration. ADT has released a very detailed Scoping Study, highlighting the incredible economic potential of the Vares project. Broadly the project economic outcomes have been modeled by the company as follows: Process Plant throughput: 800 ktpa Initial capital expenditure: USD$178 million FID to first production: 13 months Payback period: 8 months Post Tax NPV discounted at 8%: USD$916 million (approx AUD$1.3 billion) Post Tax IRR: 107% These are world-class metrics by any measure, with an economic capital intensity (initial CAPEX/NPV8) less than half of comparable projects we have examined. We examined a couple of acquisitions for comparable projects (albeit with inferior economic returns) and noted that: S32 acquired Arizona mining at a value approximately 70% of the project's NPV8 - at scoping study stage Zijin acquired Nevsun at approximately 90% of NPV8 in neighboring Serbia - at pre-feasibility study stage. ADT is currently trading at approximately 18% of NPV8 - at scoping study stage. As such we believe any transaction would need to be priced at a minimum of 60% of NPV8 for the management team (who hold ~30% of the company) to even consider. Large miners like Rio Tinto, Lundin, Freeport McMoran and Zijin are active in neighboring countries and would find ADT a very attractive acquisition now that there has been demonstrable progress in terms of feasibility studies. There is a profound lack of quality projects available globally and this has driven up acquisition prices substantially over the last 10 years. We also note that base metals are at a cyclical low and ADT's ground is still very much under-explored, which will provide comfort to any potential acquirer. Looking ahead we see several catalysts on the horizon: London stock exchange listing in progress - we expect the LSE listing to cause ADTs value to rise given the current valuation differential between Vares and similar projects Further potential exploration upside from current and future drilling programs at Vares (4 rigs onsite) - has the potential to further improve project economics Exploitation, operating and mining licences - all currently being progressed Environmental and planning permits - all currently being progressed Further geotechnical, mining, environmental and metallurgy studies leading to the completion of Definite Feasibility Study within 12 months. Risks we see are: Potential delays in permits and licences - this has been a minor issue in the past but appears to be proceeding more smoothly now. Sovereign risk - we consider this to be in line with neighboring Serbia Outcomes from further feasibility studies resulting in marginally higher CAPEX We believe ADT is a very compelling, well-priced opportunity for the resource investor with material potential upside that may be realised via a takeover from a larger miner or by the company bringing the project into production in its own right. Disclaimer: This article does not take into account your investment objectives, particular needs or financial situation; and should not be construed as advice in any way. The author holds shares in ADT. I explicitly began my investing education by reading what is considered the bible to value investors: Security Analysis by Benjamin Graham. To be honest, I couldn't and still haven't finished the book as I found it fairly dry and uninspiring; especially for a young, new investor. Thankfully, there are a whole universe of books out there, and I list a number of books I found have useful in my investing education.

1) Am I being too subtle - Sam Zell Sam Zell is a self-made billionaire, who earned his fortune primarily via real estate. His blunt, spare and contrarian style makes for a refreshing read; the title is a question he often asks himself which reflects his personality. The book is filled with business wisdom, covering a wide range of time eras, industries, personalities, successes and failures. Themes covered comprehensively are real estate investment, controlling risk and value investing. 2) Dead companies walking - Scott Fearon This book is mandatory reading for our investment team. Written by an investment manager it focuses primarily on why, when and how companies fail. By learning the warning signs, and avoiding an investment in a company which may fail; readers learn a great deal about becoming a much better investor. Chock full of practical advice and wisdom, major themes include the psychology of investing, the role of cognitive bias in business and the importance of time horizons. 3) King Icahn - Mark Stevens This book provides an insight into the personality, mindset and business philosophy of Carl Icahn, one of the greatest investors of our era. It covers the early part of his career comprehensively, and provides a great overview of 1980's corporate America from the perspective of a corporate raider or activist. In particular, the book articulates how much value can often be overlooked by passive shareholders and how it can be released by a well motivated and funded activist. 4) Metal Men - Craig Copetas An intriguing book about the hard and fast world of commodity trading; and the ascent of Marc Rich who founded the world's largest commodity trading company today, Glencore. The physical mechanics of commodity trading are fascinating; encompassing a multitude of different aspects such as financial, geo-political and logistical. Major themes broached are the mechanics of physical commodity trading, risk management and the effects of the geo-political environment on trade flows and commodity prices. 5) 100 Baggers - Chris Mayer This book examines the investor's holy grail of the 100 bagger or making 100 times your money invested on a stock; it is an update on a book on the same subject written in the 1970's. The beauty in this book is the breadth of the content, as the author examines a multitude of historical examples and the various elements that led to their 100 bagger status. We learn very quickly there is no 'magic bullet' for obtaining outsized returns, but there are a number of factors that can increase our probability of investing in one of these companies. Major themes are the impact of compounding returns over longer time frames, evaluating the quality of a company and how to maintain a long term perspective on your investments. 6) The Most Important Thing - Howard Marks Howard Marks is an investor well known for co-founding Oaktree Capital, a value orientated asset manager. This book is effectively a compilation of writings on various aspects of investing from the perspective of a value investor. Whilst a little repetitive, it hammers home a number of factors that any serious investor should consider when making any investment. Major themes are the thought process behind investing 'defensively', understanding and managing risk and expectations. 7) Margin of Safety - Seth Klarman Written by Seth Klarman, a highly respected investment manager, this is one of the most sought after investment books. The book is divided into 3 sections encompassing: where and how investors typically make mistakes, an overview of a value investing philosophy primarily focused on risk mitigation and finally a number of case studies and discussion on portfolio management. This book has a lot of value for anyone regardless of your investment experience or methodology. 8) My own story - Bernard Baruch The author was a well known financier in the early 20th century before becoming a statesman. This is a classic account of the economic change in the US as experienced through the lens of a successful stock market investor. Baruch's humility and wisdom shine through this book, which is filled with many practical examples and lessons on life and the markets amplified by his obvious gift for story telling. In particular, I found his lessons and recounting of periods of desperate economic times to be enlightening. 9) Education of a Speculator - Victor Niederhoffer This is a wild account of the author's life and investment principles. This is a difficult read, it is clear the author is brilliant but also deeply flawed. There are many valuable nuggets to be extracted by a patient reader, such as the necessity to perform your own analysis of opportunities regardless of the 'commonly held' or market knowledge. Major themes include the necessity of risk management, probabilistic investing and embracing randomness. The author's honesty and candidness is refreshing throughout, although a lot of biographical elements can be skipped over. 10) What works on Wall Street - James O'Shaughnessy This book is effectively a statistical study of the historical returns achieved by various investing strategies. The real value in this book is educating the reader on various methods or factors which may contribute to an investment return; which provides a lot of food for thought for the reader in formulating their own investment methologies. 11) The investment checklist - Michael Shearn This book focuses on evaluating a company using fundamentals. This is quite a dense book and covers a lot of ground; I particularly found the author's focus on management useful which is often overlooked in investment books. In addition, the emphasis on utilising investment checklists in the decision making process I think is especially important to ensure consistency in the investment process. 12) The Art of Speculation - Phillip Carret Phillip Carret ran one of the first investment funds in the US, the Pioneer Fund, for 55 years starting from 1928. He was idolised by a young Warren Buffet and had a great long term record over a long time period. The book covers a lot of ground: market cycles, technical vs fundamental factors and security analysis to mention a few topics. Even though the examples are now dated, the concepts are all sound and still very relevant to today's markets. |

Archives

September 2023

|

Copyright © Datt Capital 2018

The information on this website is prepared and issued by Datt Capital Pty Ltd (ABN 37 124 330 865 AFSL 542100) (Datt Capital). The information is intended for wholesale clients within the meaning of section 761G or 761GA of the Corporations act 2001 (Cth) (Corporations Act) and must not be made available to any persons that are “retail clients” for the purpose of the Corporations Act.

Datt Capital is the investment manager of The Datt Capital Absolute Return Fund (Fund) which is available to wholesale investors only. Fundhost Limited (ABN 69092 517 087 AFSL 233045) (Fundhost) is the issuer and trustee of the Fund. An investment in the Fund will only be available through a valid application form attached to the information memorandum. Before making any decision to make or hold any investment in the Fund you should consider the information memorandum in full. The information contained on this website or in any email is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation, or which would subject Datt Capital or Fundhost Limited to any registration or other requirement within such jurisdiction or country. Datt Capital may provide general information to help you understand our investment approach. Any financial advice we provide has not considered your personal circumstances and may not be suitable for you. To the extent permitted by law, Datt Capital and Fundhost, their officers, employees, consultants, advisers and authorised representatives, are not liable for any loss or damage arising as a result of any reliance placed on this document. Information has been obtained from sources believed to be reliable, but we do not represent it is accurate or complete, and it should not be relied upon as such. Datt Capital and Fundhost do not guarantee investment performance or distributions, and the value of your investment may rise or fall. Past performance is not an indicator of future performance

The information on this website is prepared and issued by Datt Capital Pty Ltd (ABN 37 124 330 865 AFSL 542100) (Datt Capital). The information is intended for wholesale clients within the meaning of section 761G or 761GA of the Corporations act 2001 (Cth) (Corporations Act) and must not be made available to any persons that are “retail clients” for the purpose of the Corporations Act.

Datt Capital is the investment manager of The Datt Capital Absolute Return Fund (Fund) which is available to wholesale investors only. Fundhost Limited (ABN 69092 517 087 AFSL 233045) (Fundhost) is the issuer and trustee of the Fund. An investment in the Fund will only be available through a valid application form attached to the information memorandum. Before making any decision to make or hold any investment in the Fund you should consider the information memorandum in full. The information contained on this website or in any email is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation, or which would subject Datt Capital or Fundhost Limited to any registration or other requirement within such jurisdiction or country. Datt Capital may provide general information to help you understand our investment approach. Any financial advice we provide has not considered your personal circumstances and may not be suitable for you. To the extent permitted by law, Datt Capital and Fundhost, their officers, employees, consultants, advisers and authorised representatives, are not liable for any loss or damage arising as a result of any reliance placed on this document. Information has been obtained from sources believed to be reliable, but we do not represent it is accurate or complete, and it should not be relied upon as such. Datt Capital and Fundhost do not guarantee investment performance or distributions, and the value of your investment may rise or fall. Past performance is not an indicator of future performance

RSS Feed

RSS Feed