|

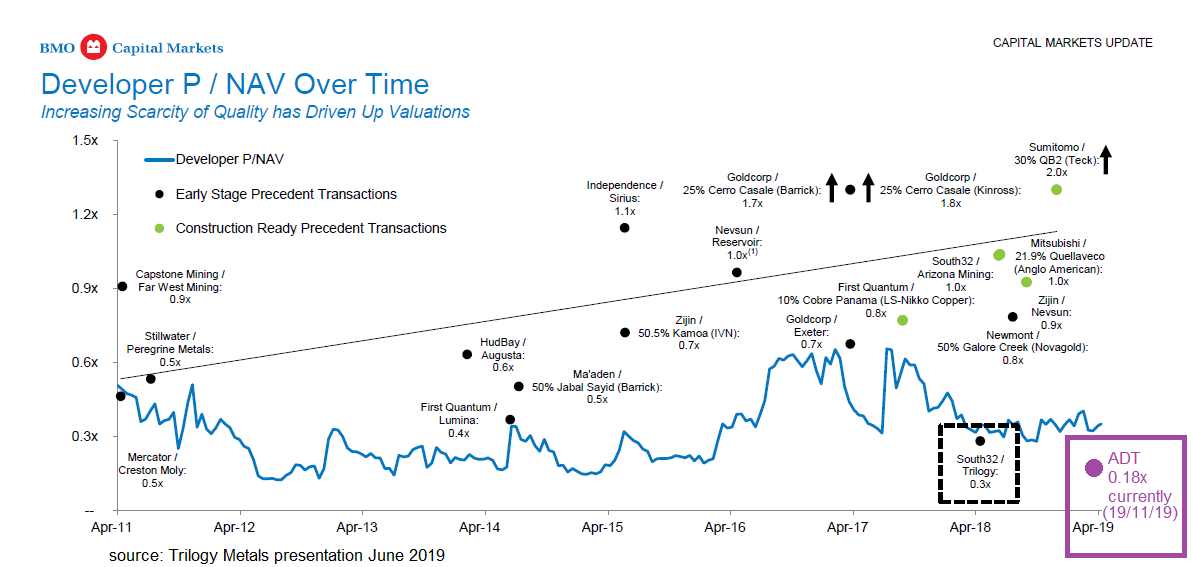

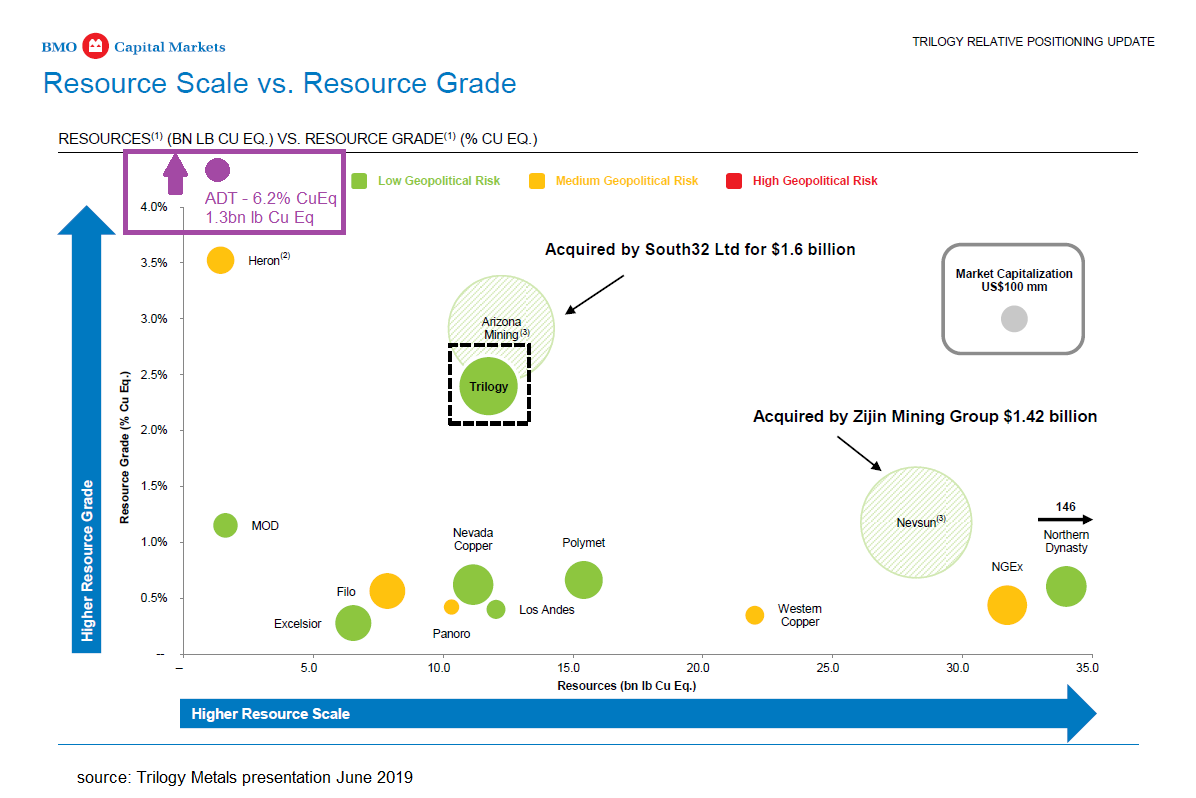

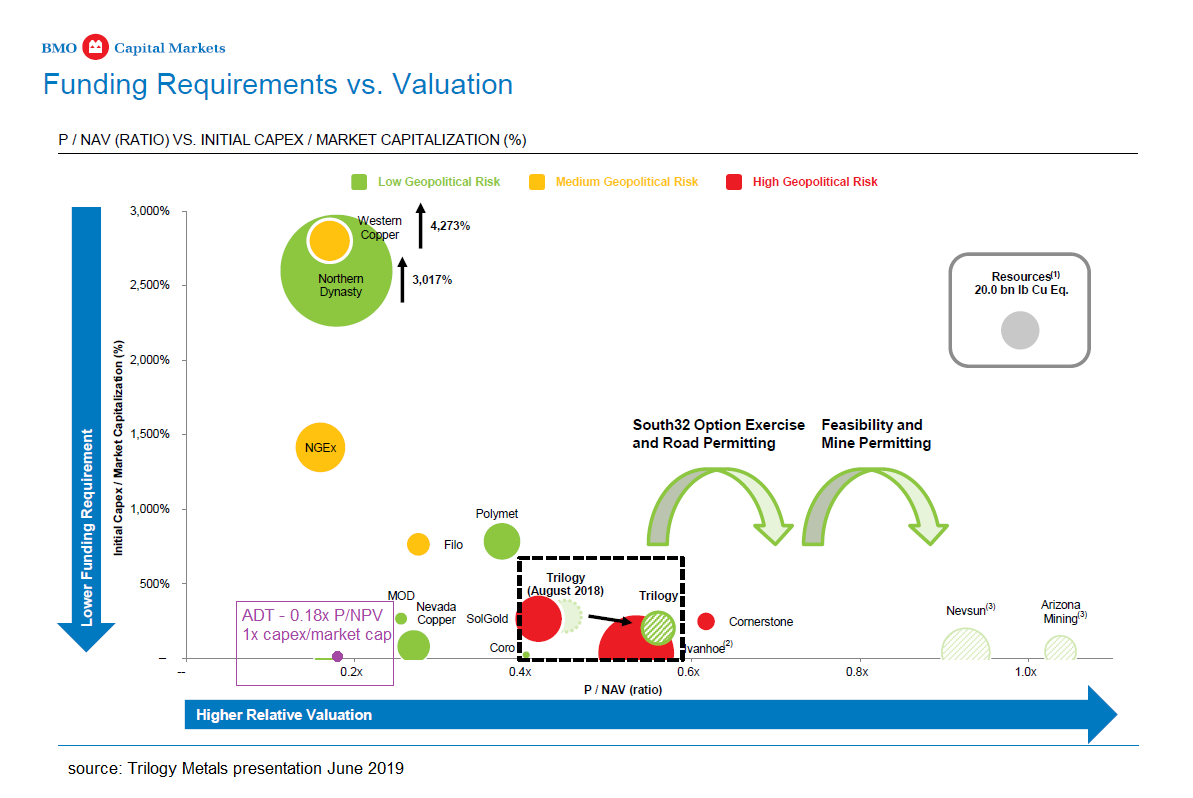

This is an addendum to our investment thesis released on Adriatic Metals ('ADT'). We have been requested by several investors to share our research on similar projects as Vares. We have found that the overall quality of the Rupice deposit has been largely overshadowed by the perception of Bosnia as a mining jurisdiction. We hope this brief comparison will demonstrate the utter uniqueness of the still-growing Rupice deposit relative to other base metal peers. Base metal projects are often converted to copper equivalent (CuEq) to provide a simple method to compare different deposits, especially in the case of polymetallic deposits. ADT has not provided CuEq figures, most likely as the Vares project deposits are copper poor; and have used gold and zinc equivalents (AuEq, ZnEq) as a proxy. We thought it would be beneficial to convert the resource to CuEq just to provide a broad economic comparison relative to other projects. Accordingly, for the Rupice deposit, we come up with an approximate CuEq of ~6.2%. This includes the contribution of barite and takes into account the preliminary met recoveries disclosed by the company. We should note that 'equivalent' grades should never be used solely as the basis for an investment decision by investors, and more detailed analysis should be conducted. The following comparison charts demonstrate how unique and undervalued ADT is relative to comparable base metal projects. It is extremely rare for a resource project to possess an IRR >100%, an NPV above AUD$1 billion and a payback period of less than 12 months. There is a material shortage of commercial base metal development projects available. This is largely due to the exploration decline post-2012 and a continuing skew towards gold relative to base metals in terms of exploration spend. The overall quality of new base metal has fallen dramatically over time, as many high grade and close to the surface deposits have already been discovered.

What's it worth? We examined a peer group of approximately 25 undeveloped resource projects globally and noted the following: Unfinanced projects on average trade at circa 30% of NPV. We believe that ADT should at minimum, trade at the peer group average. Financed projects on average trade at circa 55% of NPV. We believe that ADT should trade at a premium to the peer group average as they advance through the permitting, feasibility and initial financing processes which we believe will occur over the next 12 months. ADT is without a doubt, the standout base metal project in terms of IRR, NPV, capital efficiency, and other economic metrics. What happens now? ADT possesses a unique resource of almost unparalleled quality which drives the projects exceptional potential economic returns along with a very favourable cost jurisdiction. Over the next 12 months, we expect the company to continue to build upon the initial resource at Rupice as well as further explore brownfield and greenfield prospects selectively. We also believe that within this time frame that the company should complete a detailed feasibility study as well as completing the permits required for the mining and processing operations. We should add that any further discoveries or extensions in the project life will only increase already exceptional returns. We also note that the upcoming LSE listing will broaden ADT's investor base and likely provide another potential catalyst for the stock to rerate. Disclaimer: This article does not take into account your investment objectives, particular needs or financial situation; and should not be construed as advice in any way. The author holds shares in ADT. Adriatic Metals ('ADT') are a base metal developer in Bosnia & Herzegovina (BiH), with a world-class resource in a global scale mineral province.

The breakup of Yugoslavia and the consequent Bosnian war, along with high upfront costs for mining concessions has largely preserved the exploration opportunity in BiH despite a long, proud history of mining. As such, the area has barely been touched by modern exploration techniques which bode well given its geographic and geological locality. The team at ADT recognised the significant opportunity at hand and managed to secure a portfolio of high-quality assets via its first-mover advantage; it is still the only listed resource company globally with operations in the BiH. The BiH is a stable, democratic nation with a favourable regulatory environment and supportive of mining. Foreign investors possess the same rights as locals, tax and royalty rates are very attractive and the costs of operating are extremely low. Serbia, which borders Bosnia, has attracted significant investment from a multitude of mining majors in a similar geological setting. ADT's founders discovered a warehouse of Yugoslav era technical reports dating back 30 years, providing valuable information on historical brownfield projects and exploration activities that allowed it to grasp the low hanging fruit in terms of prospectivity. Consequently, the company has made a world-class, poly-metallic greenfield discovery in Rupice (9.4mt @10.1 g/t Au equivalent) along with significantly advancing a brownfield asset in Veovaca, collectively referred to as the Vares project. As a result, ADT was the ASX's best performing IPO in 2018. We believe the potential for further quality discoveries is high given the lack of systematic, modern exploration. ADT has released a very detailed Scoping Study, highlighting the incredible economic potential of the Vares project. Broadly the project economic outcomes have been modeled by the company as follows: Process Plant throughput: 800 ktpa Initial capital expenditure: USD$178 million FID to first production: 13 months Payback period: 8 months Post Tax NPV discounted at 8%: USD$916 million (approx AUD$1.3 billion) Post Tax IRR: 107% These are world-class metrics by any measure, with an economic capital intensity (initial CAPEX/NPV8) less than half of comparable projects we have examined. We examined a couple of acquisitions for comparable projects (albeit with inferior economic returns) and noted that: S32 acquired Arizona mining at a value approximately 70% of the project's NPV8 - at scoping study stage Zijin acquired Nevsun at approximately 90% of NPV8 in neighboring Serbia - at pre-feasibility study stage. ADT is currently trading at approximately 18% of NPV8 - at scoping study stage. As such we believe any transaction would need to be priced at a minimum of 60% of NPV8 for the management team (who hold ~30% of the company) to even consider. Large miners like Rio Tinto, Lundin, Freeport McMoran and Zijin are active in neighboring countries and would find ADT a very attractive acquisition now that there has been demonstrable progress in terms of feasibility studies. There is a profound lack of quality projects available globally and this has driven up acquisition prices substantially over the last 10 years. We also note that base metals are at a cyclical low and ADT's ground is still very much under-explored, which will provide comfort to any potential acquirer. Looking ahead we see several catalysts on the horizon: London stock exchange listing in progress - we expect the LSE listing to cause ADTs value to rise given the current valuation differential between Vares and similar projects Further potential exploration upside from current and future drilling programs at Vares (4 rigs onsite) - has the potential to further improve project economics Exploitation, operating and mining licences - all currently being progressed Environmental and planning permits - all currently being progressed Further geotechnical, mining, environmental and metallurgy studies leading to the completion of Definite Feasibility Study within 12 months. Risks we see are: Potential delays in permits and licences - this has been a minor issue in the past but appears to be proceeding more smoothly now. Sovereign risk - we consider this to be in line with neighboring Serbia Outcomes from further feasibility studies resulting in marginally higher CAPEX We believe ADT is a very compelling, well-priced opportunity for the resource investor with material potential upside that may be realised via a takeover from a larger miner or by the company bringing the project into production in its own right. Disclaimer: This article does not take into account your investment objectives, particular needs or financial situation; and should not be construed as advice in any way. The author holds shares in ADT. |

Archives

September 2023

|

Copyright © Datt Capital 2018

The information on this website is prepared and issued by Datt Capital Pty Ltd (ABN 37 124 330 865 AFSL 542100) (Datt Capital). The information is intended for wholesale clients within the meaning of section 761G or 761GA of the Corporations act 2001 (Cth) (Corporations Act) and must not be made available to any persons that are “retail clients” for the purpose of the Corporations Act.

Datt Capital is the investment manager of The Datt Capital Absolute Return Fund (Fund) which is available to wholesale investors only. Fundhost Limited (ABN 69092 517 087 AFSL 233045) (Fundhost) is the issuer and trustee of the Fund. An investment in the Fund will only be available through a valid application form attached to the information memorandum. Before making any decision to make or hold any investment in the Fund you should consider the information memorandum in full. The information contained on this website or in any email is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation, or which would subject Datt Capital or Fundhost Limited to any registration or other requirement within such jurisdiction or country. Datt Capital may provide general information to help you understand our investment approach. Any financial advice we provide has not considered your personal circumstances and may not be suitable for you. To the extent permitted by law, Datt Capital and Fundhost, their officers, employees, consultants, advisers and authorised representatives, are not liable for any loss or damage arising as a result of any reliance placed on this document. Information has been obtained from sources believed to be reliable, but we do not represent it is accurate or complete, and it should not be relied upon as such. Datt Capital and Fundhost do not guarantee investment performance or distributions, and the value of your investment may rise or fall. Past performance is not an indicator of future performance

The information on this website is prepared and issued by Datt Capital Pty Ltd (ABN 37 124 330 865 AFSL 542100) (Datt Capital). The information is intended for wholesale clients within the meaning of section 761G or 761GA of the Corporations act 2001 (Cth) (Corporations Act) and must not be made available to any persons that are “retail clients” for the purpose of the Corporations Act.

Datt Capital is the investment manager of The Datt Capital Absolute Return Fund (Fund) which is available to wholesale investors only. Fundhost Limited (ABN 69092 517 087 AFSL 233045) (Fundhost) is the issuer and trustee of the Fund. An investment in the Fund will only be available through a valid application form attached to the information memorandum. Before making any decision to make or hold any investment in the Fund you should consider the information memorandum in full. The information contained on this website or in any email is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation, or which would subject Datt Capital or Fundhost Limited to any registration or other requirement within such jurisdiction or country. Datt Capital may provide general information to help you understand our investment approach. Any financial advice we provide has not considered your personal circumstances and may not be suitable for you. To the extent permitted by law, Datt Capital and Fundhost, their officers, employees, consultants, advisers and authorised representatives, are not liable for any loss or damage arising as a result of any reliance placed on this document. Information has been obtained from sources believed to be reliable, but we do not represent it is accurate or complete, and it should not be relied upon as such. Datt Capital and Fundhost do not guarantee investment performance or distributions, and the value of your investment may rise or fall. Past performance is not an indicator of future performance

RSS Feed

RSS Feed