|

Russia's invasion of Ukraine and the subsequent sanctions against it enforced by the Western world have enormously affected energy and broader commodity markets. Russia supplies a substantial portion of the world's energy, food and metals needs. Although Western sanctions have been oriented specifically towards maintaining the continuity of supply for critical goods however, we have seen a strong 'self-sanctioning' effect amongst traditional customers of Russia. For instance, a commodity trading house may struggle to obtain the requisite insurance and finance to cover the purchase and transport of a shipment of Russian-origin commodities. As such, almost overnight, we have seen an enormous uplift in demand for commodities of non-Russian origin to fill this sudden supply gap. For instance, Newcastle thermal coal futures, an export-focused commodity, surged 46% overnight to close at US$446 a tonne. This is in contrast to prices of ~US$190 a tonne only 2 months ago. The important Asian LNG benchmark, the JKM index, is currently trading ~US$35/MMBtu; significantly higher than in recent months. In addition, the price of crude oil has exploded with the Brent benchmark currently trading at ~USD$116 a barrel vs USD$77 a barrel 2 months ago. These circumstances have thrown up unique opportunities for Australian focused investors to capitalise upon. Whitehaven Coal (ASX:WHC)

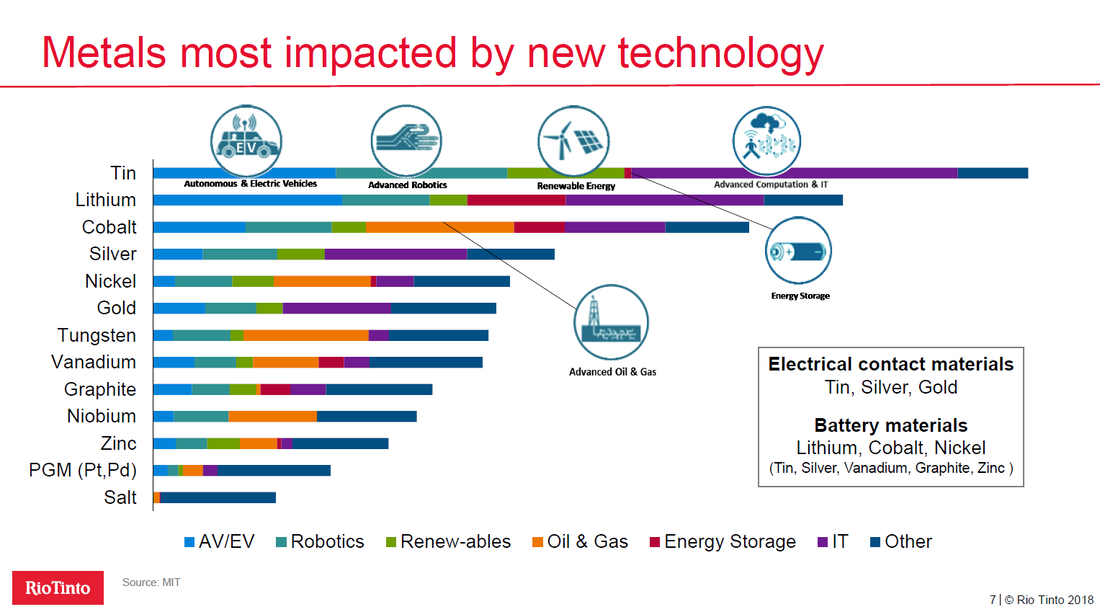

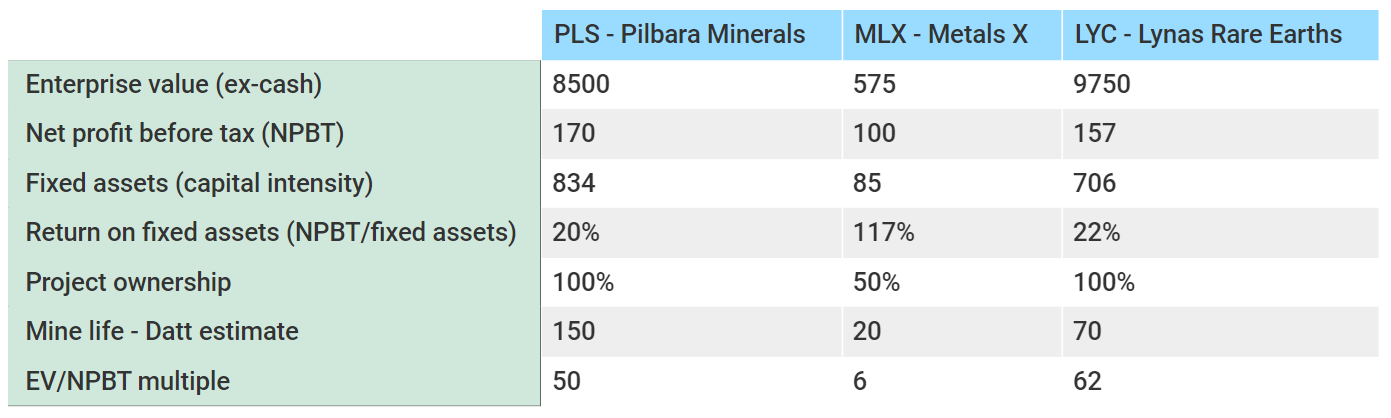

WHC produces high-quality thermal coal in NSW for export primarily to Japanese and Korean customers. Russia coal imports supply an estimated 15-20% of Japanese and Korean coal demand. Consequently, WHC's customers will likely be willing to increase purchase volumes from Whitehaven at higher prices than has been traditionally achievable. In WHC's last half-yearly report, they managed to achieve an average realised price of AUD$211 per tonne of coal sold. With current spot prices over AUD$600 a tonne, we believe that Whitehaven is well equipped to capture these higher prices at greater production volumes than last quarter. Adding to the attractiveness of Whitehaven is the commencement of a $400 million buyback, where it may purchase up to 10% of the company's share capital on-market. The debt-free balance sheet and high-quality assets make this a compelling value proposition at a market cap of less than AUD$4 billion. Woodside Petroleum (ASX:WPL) WPL holds a suite of Tier 1 petroleum-producing assets primarily located in Western Australia and the Gulf of Mexico. It has recently merged (subject to completion) with BHP's petroleum division and will be a global top 10 oil and gas (O&G) company in its own right. WPL is heavily exposed to the LNG markets, primarily exporting to Asia. The company's realised prices for LNG and oil were USD$28/MMBtu and USD$80/bbl respectively. Accordingly, we see WPL as possessing strong leverage to higher O&G prices going forward whilst also paying an attractive dividend yield. Santos (ASX:STO) Santos holds a suite of O&G production assets located in Australia and PNG. Last calendar year, STO managed to capture realised prices of US$9/MMBtu for LNG and US$76/bbl respectively. Accordingly, there is a strong opportunity to capture materially higher prices given the current market conditions. We also expect that STO will reduce its stake in certain development assets which provide the potential for future capital returns along with its regular dividend. Disclaimer: This article does not take into account your investment objectives, particular needs or financial situation; and should not be construed as advice in any way. The author holds shares in all companies discussed. The battery metals boom is primarily driven by commodity demand from present and predicted electric vehicle uptake. Whilst we don't have a strong view on the likelihood of electric vehicle penetration reaching an arbitrary threshold within a certain time frame, it is impossible to ignore the definite trend towards greater electrification in society However, by focusing purely on battery metals, in many ways, some are missing the forest for the trees. Pure battery exposure is not without risks, given the plethora of competing battery technologies vying for dominance in a growing market. The reality is that electric vehicles require a range of associated technologies which require an assortment of materials; all of which supply is critical for the further adoption of electric vehicles. Ultimately, investors need to ask themselves what they want to achieve and within which risk parameters? At Datt Capital, we think laterally in the way to achieve our objectives in the most appropriate manner; namely, achieve the highest return at the lowest possible risk ideally in sectors that are experiencing strong tailwinds. Accordingly, we identified three core commodities that enjoy positive demand/supply dynamics, were critical to future electrification, and by proxy have exposure to rapidly developing future technologies. These three most critical elements to the future intensification of electrification are rare earths, tin and lithium. We focused on the ASX-listed, sector leaders in each commodity identified which led us to Lynas Rare Earths (LYC:ASX), Metals X (MLX:ASX), and Pilbara Minerals (PLS:ASX). All companies are producing profitably in the current bullish environment, as would be expected for a sector leader. Commodities as an asset class are highly cyclical, so it is important to have select exposure to low-cost, tier 1 producers at the right price. Risk can also be mitigated by taking a diversified, portfolio approach to commodity exposures in line with an investor's risk profile. Value is always relative, as such, we have compared these 3 sector leaders using some high-level, key factors namely: Enterprise value (EV) Net profit before tax (NPBT) Return on fixed assets fixed asset values Project ownership Estimated mine life EV/NPBT multiple The table above is derived from the latest half-year figures reported by all the companies.

This exercise ultimately identified that Metals X (MLX:ASX), despite enjoying superior business and industry fundamentals, is materially undervalued against its peer group of market-leading battery metals companies. This value divergence between Metals X and its peer group is exceptionally puzzling, given that tin is the metal most affected by the adoption of new technologies, across the board. Accordingly, we consider that Metals X is undervalued by some measure; trading at only a 6x EV/NPBT multiple relative to its comparables both trading at over 50x EV/NPBT multiples. It is important to note that commodity spot prices for all 3 companies have strengthened considerably from the new calendar year, and all three are likely to continue to enjoy superb business returns in present market conditions. We have previously examined the large supply constraints evident in the tin industry in a previous article that can be found via this link: https://bit.ly/Datt-MLX21 Disclaimer: This article does not take into account your investment objectives, particular needs or financial situation; and should not be construed as advice in any way. The author holds shares in all companies discussed |

Archives

September 2023

|

Copyright © Datt Capital 2018

The information on this website is prepared and issued by Datt Capital Pty Ltd (ABN 37 124 330 865 AFSL 542100) (Datt Capital). The information is intended for wholesale clients within the meaning of section 761G or 761GA of the Corporations act 2001 (Cth) (Corporations Act) and must not be made available to any persons that are “retail clients” for the purpose of the Corporations Act.

Datt Capital is the investment manager of The Datt Capital Absolute Return Fund (Fund) which is available to wholesale investors only. Fundhost Limited (ABN 69092 517 087 AFSL 233045) (Fundhost) is the issuer and trustee of the Fund. An investment in the Fund will only be available through a valid application form attached to the information memorandum. Before making any decision to make or hold any investment in the Fund you should consider the information memorandum in full. The information contained on this website or in any email is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation, or which would subject Datt Capital or Fundhost Limited to any registration or other requirement within such jurisdiction or country. Datt Capital may provide general information to help you understand our investment approach. Any financial advice we provide has not considered your personal circumstances and may not be suitable for you. To the extent permitted by law, Datt Capital and Fundhost, their officers, employees, consultants, advisers and authorised representatives, are not liable for any loss or damage arising as a result of any reliance placed on this document. Information has been obtained from sources believed to be reliable, but we do not represent it is accurate or complete, and it should not be relied upon as such. Datt Capital and Fundhost do not guarantee investment performance or distributions, and the value of your investment may rise or fall. Past performance is not an indicator of future performance

The information on this website is prepared and issued by Datt Capital Pty Ltd (ABN 37 124 330 865 AFSL 542100) (Datt Capital). The information is intended for wholesale clients within the meaning of section 761G or 761GA of the Corporations act 2001 (Cth) (Corporations Act) and must not be made available to any persons that are “retail clients” for the purpose of the Corporations Act.

Datt Capital is the investment manager of The Datt Capital Absolute Return Fund (Fund) which is available to wholesale investors only. Fundhost Limited (ABN 69092 517 087 AFSL 233045) (Fundhost) is the issuer and trustee of the Fund. An investment in the Fund will only be available through a valid application form attached to the information memorandum. Before making any decision to make or hold any investment in the Fund you should consider the information memorandum in full. The information contained on this website or in any email is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation, or which would subject Datt Capital or Fundhost Limited to any registration or other requirement within such jurisdiction or country. Datt Capital may provide general information to help you understand our investment approach. Any financial advice we provide has not considered your personal circumstances and may not be suitable for you. To the extent permitted by law, Datt Capital and Fundhost, their officers, employees, consultants, advisers and authorised representatives, are not liable for any loss or damage arising as a result of any reliance placed on this document. Information has been obtained from sources believed to be reliable, but we do not represent it is accurate or complete, and it should not be relied upon as such. Datt Capital and Fundhost do not guarantee investment performance or distributions, and the value of your investment may rise or fall. Past performance is not an indicator of future performance

RSS Feed

RSS Feed