|

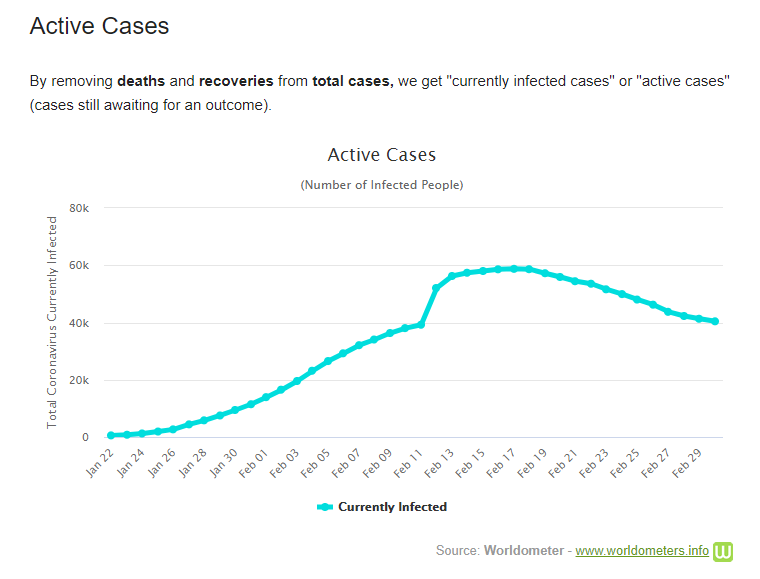

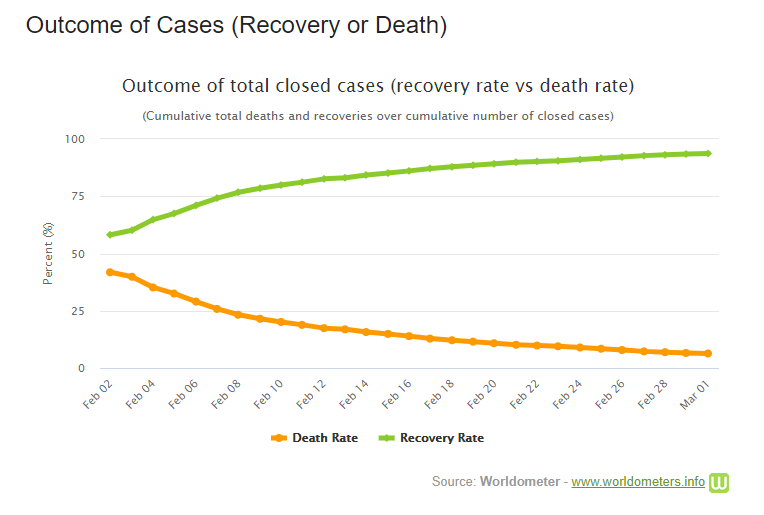

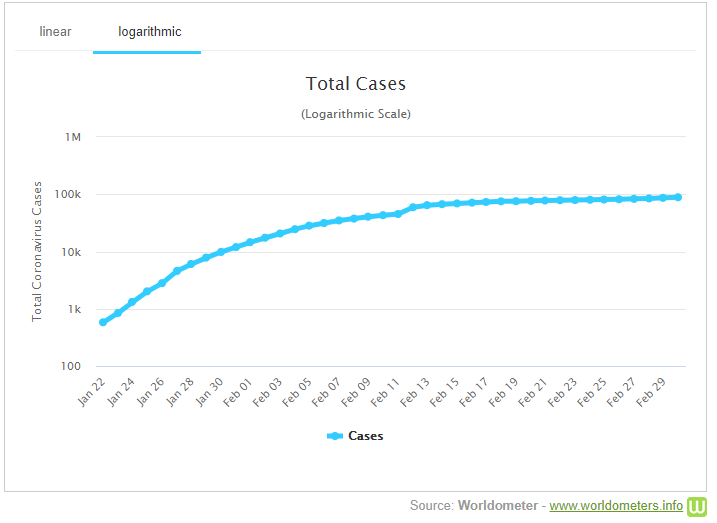

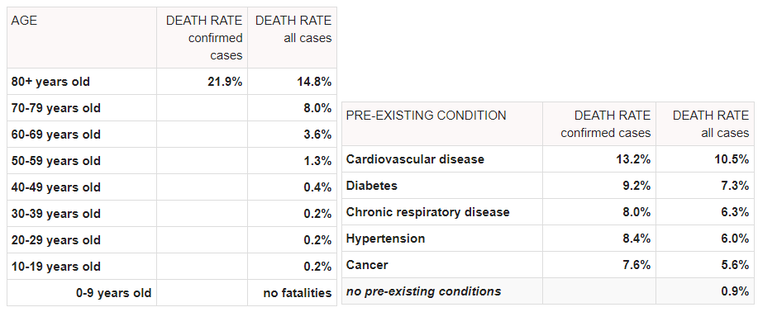

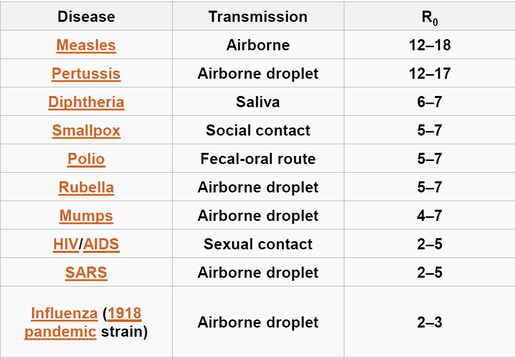

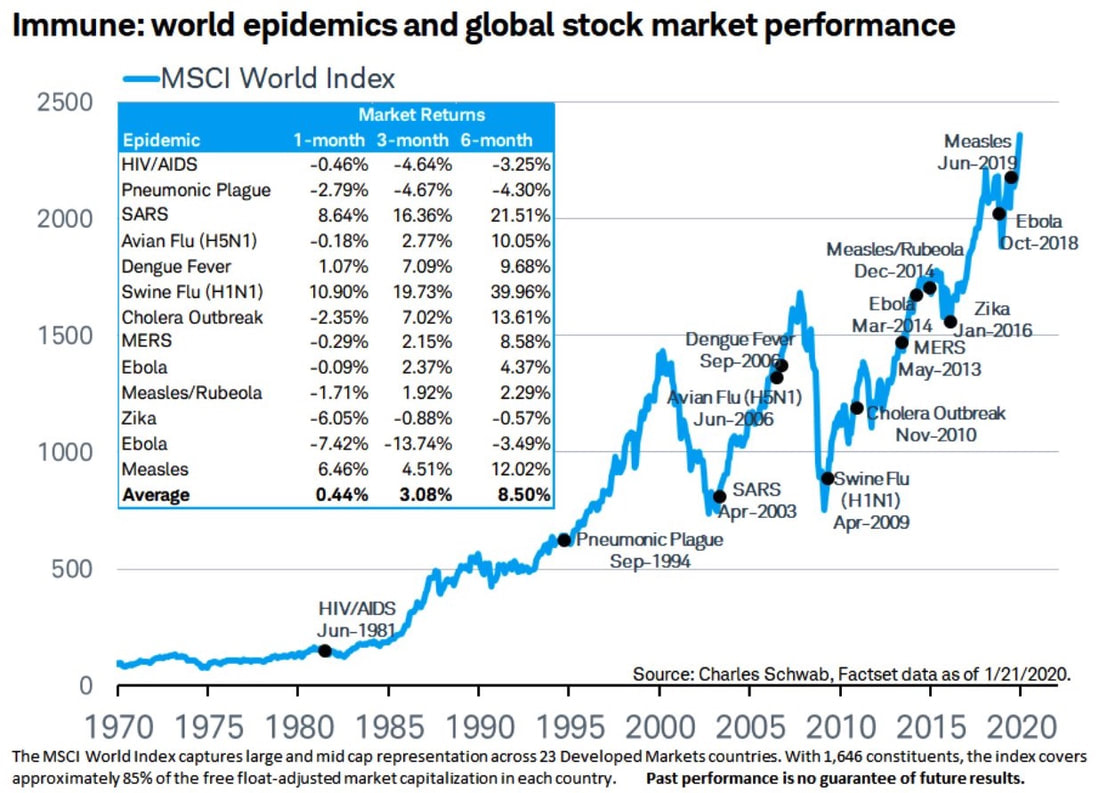

At present, there have been approximately 90,000 cases of clinically confirmed SARS-CoV-2 ('Coronavirus'). We estimate that there have been potentially double this number who have been afflicted by the virus but have not reported due to recoveries. There have been approximately 3,000 deaths and 45,000 recoveries, with approximately 42,000 active cases worldwide. Interestingly, the number of active cases worldwide is trending down despite the virus spreading geographically. Also, the recovery rate vs death rate is trending strongly up implying that medical professionals are becoming increasingly successful at treating the condition. Despite some expressing fearful, dystopian views over social and mass media, the actual growth of total cases is not exponential and appears to be flatlining in absolute terms. As can be expected, older individuals who have pre-existing health conditions are at higher risk of death from the virus. Much of the rhetoric has been around the rate of spread, or the average number of secondary cases arising from a primary case (R0 value). It is estimated that the R0 value for Coronavirus is between 2 & 3. Whilst prima facie, this appears to be high, especially when compounded, it is a small value relative to some other previously common diseases. Other factors that may determine how prevalent the virus becomes in a nation also include cultural factors as social customs - 'kissing cultures' as generally practiced in Italy and Iran have proven susceptible. Population density, public sanitation, and hygiene will also be large factors in the spread of the virus. Whilst general fears exist that the Coronavirus may become as prevalent as the Spanish Flu pandemic of 1918, we do not necessarily believe this hypothesis given there are several key differences in circumstances. Most prominent is the fact that modern sanitation and hygiene were still in their infancy during this period in the Western world, as well as the fact that the first World War led to greater densities of people in close quarters most who would have been geographically mobile. We are beginning to see green shoots out of the chaos. Our monitoring of traffic data from Chinese cities demonstrates an uptick in traffic volume over the past week relative to prior weeks; albeit at still depressed levels. Wuhan at the epicenter of the epidemic is currently experiencing traffic volume about 20% of average; whilst cities further afield appear to be slowly trending back towards their annual averages. We expect traffic volumes to recover fully in a month or two. We are also encouraged by historical data relating to periods immediately post an epidemic, with an average 6-month return of around +8.5%. Our evaluation of the data behind the Coronavirus outbreak along with the emergence of some attractive market opportunities leaves us with a positive sense regarding the medium-term market outlook.

Disclaimer: This article does not take into account your investment objectives, particular needs or financial situation; and should not be construed as advice in any way. 18/8/2020 23:53:13

This data really shows how covid is affecting everywhere, thanks for this great and informative article truly detailed and onpoint. Comments are closed.

|

Archives

September 2023

|

Copyright © Datt Capital 2018

The information on this website is prepared and issued by Datt Capital Pty Ltd (ABN 37 124 330 865 AFSL 542100) (Datt Capital). The information is intended for wholesale clients within the meaning of section 761G or 761GA of the Corporations act 2001 (Cth) (Corporations Act) and must not be made available to any persons that are “retail clients” for the purpose of the Corporations Act.

Datt Capital is the investment manager of The Datt Capital Absolute Return Fund (Fund) which is available to wholesale investors only. Fundhost Limited (ABN 69092 517 087 AFSL 233045) (Fundhost) is the issuer and trustee of the Fund. An investment in the Fund will only be available through a valid application form attached to the information memorandum. Before making any decision to make or hold any investment in the Fund you should consider the information memorandum in full. The information contained on this website or in any email is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation, or which would subject Datt Capital or Fundhost Limited to any registration or other requirement within such jurisdiction or country. Datt Capital may provide general information to help you understand our investment approach. Any financial advice we provide has not considered your personal circumstances and may not be suitable for you. To the extent permitted by law, Datt Capital and Fundhost, their officers, employees, consultants, advisers and authorised representatives, are not liable for any loss or damage arising as a result of any reliance placed on this document. Information has been obtained from sources believed to be reliable, but we do not represent it is accurate or complete, and it should not be relied upon as such. Datt Capital and Fundhost do not guarantee investment performance or distributions, and the value of your investment may rise or fall. Past performance is not an indicator of future performance

The information on this website is prepared and issued by Datt Capital Pty Ltd (ABN 37 124 330 865 AFSL 542100) (Datt Capital). The information is intended for wholesale clients within the meaning of section 761G or 761GA of the Corporations act 2001 (Cth) (Corporations Act) and must not be made available to any persons that are “retail clients” for the purpose of the Corporations Act.

Datt Capital is the investment manager of The Datt Capital Absolute Return Fund (Fund) which is available to wholesale investors only. Fundhost Limited (ABN 69092 517 087 AFSL 233045) (Fundhost) is the issuer and trustee of the Fund. An investment in the Fund will only be available through a valid application form attached to the information memorandum. Before making any decision to make or hold any investment in the Fund you should consider the information memorandum in full. The information contained on this website or in any email is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation, or which would subject Datt Capital or Fundhost Limited to any registration or other requirement within such jurisdiction or country. Datt Capital may provide general information to help you understand our investment approach. Any financial advice we provide has not considered your personal circumstances and may not be suitable for you. To the extent permitted by law, Datt Capital and Fundhost, their officers, employees, consultants, advisers and authorised representatives, are not liable for any loss or damage arising as a result of any reliance placed on this document. Information has been obtained from sources believed to be reliable, but we do not represent it is accurate or complete, and it should not be relied upon as such. Datt Capital and Fundhost do not guarantee investment performance or distributions, and the value of your investment may rise or fall. Past performance is not an indicator of future performance

RSS Feed

RSS Feed