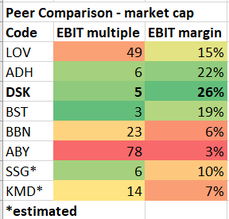

In early February this year, we wrote a piece on Livewire asking why the market was valuing Dusk Group (ASX: DSK) so cheaply? The company had a less than spectacular debut in late 2020 and subsequently has flown under the radar of many investors. But since listing, Dusk has delivered three consecutive earnings upgrades, with the share price rising around 35% since we published our original article. As part of Livewire’s reporting season coverage, I have addressed some questions about Dusk’s latest results and explain why we still believe the shares remain attractively priced. 1. Briefly explain what the company does and why you’re attracted to it (at a high level). Dusk Group is a specialist retailer operating solely within the Australian market. While known mostly for its scented candles, the company's range also includes diffusers, essential oils and other fragrance-related homewares. Historically, niche homeware retail segments have been largely a cottage industry with a long tail of small boutique merchants fulfilling demand. Dusk is the largest player in the local market, holding around 22% market share, while running only around 122 physical stores in Australia. The company foresee the potential to grow to around 160 stores throughout Australasia by 2024 and also plans to eventually expand into the UK and US markets. Dusk has a combination of soft and hard factors that make it an attractive investment proposition. The products are orientated towards making homes and offices pleasant environments, which has become exceptionally important given the recent lockdowns. In addition, the majority of the company's products are consumables or products that use consumables. This means that every sale in the present has a high probability of further follow on sales in the future, assuming the buyer remains engaged with the product itself. This confers an enormous advantage over time vs other retail niches. This "soft factor" advantage translates into hard benefits; for example, the company's loyalty program now boasts almost 700,000 highly engaged members. This translates into exceptional gross margins of almost 70%, while the team has maintained and exercised exceptional capital discipline and allocation decisions. We expect this outperformance to persist over time. 2. How did the current result compare to your expectations? What about market/analyst expectations? Dusk is a recent listing, only being listed for less than 12 months. In that short period, there have been three consecutive earnings upgrades - something quite unusual. Accordingly, Dusk has outperformed its prospectus projections by a large percentage. 3. Were there any surprises in the result or management’s commentary? Like all retailers, the first seven weeks of FY22 trade has been impacted by the Victorian and NSW lockdowns. Around half the company's store network is within these two states, but it has only affected top-line revenue by 28%. This relative outperformance demonstrates that the company's products are actively sought by its loyal customers, despite the state lockdowns. This also affirms that Dusk's products are differentiated enough versus competitors for customers to actively seek them out. This is confirmed by the statistic that 60% of the group's revenue by value is derived from Dusk rewards members 4. What do you think is the most important thing for investors to know about this company? There is significant potential for Dusk to expand overseas. The management team is very disciplined in allocating capital and is taking a careful, prudent approach given the uncertainties around COVID and international travel. However, we expect that once the present situation normalises, the company will commence its international expansion. 5. What’s your outlook for the company? While like-for-like growth sales are down slightly, we anticipate that Dusk may be able to achieve at least 80% of FY21's revenue, while maintaining an EBIT above $30 million. This assumes that social restrictions are loosened in Victoria and NSW prior to the Christmas shopping period, as well as being open during the key Mother's Day trading period. The company has also disclosed that "reopening" events generally have a large positive impact on physical stores' trading. The company’s initial foray into New Zealand has been delayed by covid induced travel restrictions, and we believe there is significant scope and potential to begin examining larger international markets such as the UK and US for near-term expansion, despite the delays being experienced within the ANZ region. 6. Do you still think the company looks attractive following the result (and the price response)? Why or why not? We believe that Dusk looks highly attractive at the current valuation. The company has a number of highly attractive factors that are conducive to future returns. These are: - Zero leverage, - High margins and cash generation, - Global expansion potential, - Broader tailwinds for their specific sector, and - An aligned and disciplined management team. The company looks highly undervalued when you examine its valuation on a peer comparison basis. Additionally, it has paid a gross yield (including franking credits) of around 11% over the past financial year, based on today’s price. We expect the company to continue to pay a sustainable, reliable dividend stream in the coming years, while holding significant upside potential from further expansion in its activities. We consider the fair value for Dusk to be around $5 a share, considering all the factors mentioned above. In a nutshell, we consider Dusk to be a Growth company that's priced as a Value stock. Disclaimer: This article does not take into account your investment objectives, particular needs or financial situation; and should not be construed as advice in any way. The author holds shares in Dusk Group (DSK:ASX). Long-term portfolio holding, Adriatic Metals, recently delivered their Definitive Feasibility Study (DFS) over the flagship Vares Project which is the final study prior to a Final Investment Decision (FID).

The DFS demonstrated the following key project metrics: • a 10-year mine life - reduced by 4 years by cutting out more marginal resources • an increase in project NPV8 to US$1.062 Billion at an IRR of 134% • Reduced project capex of US$168 million and a payback period of 8 months • an NPV8/Capex ratio of 6.3x - this is a measure of capital efficiency and it is the highest we've ever seen from a greenfield mining operation • a reduction of costs to US$7.3/oz of AgEq (silver equivalent) on an AISC (all-in-sustaining cost) basis - this is a 1st decile (bottom 10%) cost result relative to Adriatic's peer group • 15 Moz of AgEq/year production with commodity revenue streams by value being silver dominant, followed by zinc, lead and gold The study reaffirmed the world class nature of the project with a high level of confidence. Unusually, the company has managed a trifecta in terms of improving the economic outcomes of each sequential study; generally we see the opposite. The changes that drove the most recent outcomes are: • the removal of a lower quality deposit and lower value commodities such as barite which also had the benefit of reducing the number of concentrates produced to only 2 from 4 previously • the vastly simplification of the project's processing flowsheet as a result of this decision which in turn reduces delivery risk • Higher base metal prices relative to the PFS • A modified mining sequence that prioritises mining the higher grade ore at an early stage from the core Rupice deposit Importantly, the DFS demonstrates a robust project in any price environment. For instance, a 20% fall in metal prices would reduce the project IRR to ~100%; still a world class result by any metric. The Vares Project is extremely important to Bosnia and Herzegovina, and will comprise over 30% of the nation's direct foreign investment over a 10 year period as measured since 2014; as well as being the nation's single largest exporter over the project's first 5 years. The project will also employ 350 staff with a strong commitment made towards workplace diversity - 30% of the present workforce are female. The company enjoy exceptional government and community support, legacy of a strong social licence-built up over years. An exceptional gesture by the company was the formation of the Adriatic Foundation. This is a charitable trust that is focused on improving local community outcomes in 3 key areas: education, environmental protection & healthcare. The Adriatic Foundation will receive an ongoing share of project profits and was generously seeded by the founders and directors of Adriatic. Adriatic's strong ESG credentials have been recognised by the European Bank for Reconstruction and Development (EBRD) who have taken an equity stake in the company itself. This is an extremely strong point of validation, as the EBRD only participates in companies that demonstrate exceptional commitment towards best in class ESG principles. A number of important catalysts are on the horizon for the company. These are: • offtake agreements for the produced concentrate. We expect these to be agreed imminently. • final environmental permits for the project, we expect these to be granted in the next month or so • a project financing package for construction, we expect this will be delivered next month hi • the commencement of construction, the company plan to break ground in October Adriatic hold other promising assets aside from the Vares Project. The company recently hit an interval of over 20m at a grade similar to the main Rupice orebody to the north-west of the core deposit. Whilst still at an early stage, we consider that this could be a repetition of the Rupice orebody given the area is structurally controlled. This has the potential to be a real game-changer if further drilling proves this hypothesis. Independently, Adriatic also control the rest of the mineral belt surrounding Vares which we consider highly prospective with many historical mineral deposits and occurrences. The company has a US$9 million exploration budget for this calendar year. Adriatic's Raska project in Serbia also has strong economic potential in the current market environment. We believe that the project could be worth half of Adriatic's present market value on a risked NPV basis. Adriatic are targeting an MRE and scoping study to be delivered this year. Any way we look at it, we believe the company is undervalued trading at only around 35% of the Vares Project's NPV, entirely ignoring its other assets. Similar assets have transacted for in excess of 80% of NPV. Another strong attraction is the company's strong commitment towards strong ESG principles which we believe are sound and essential business practices in today's world. We remain long-term shareholders of Adriatic Metals. Disclaimer: This article does not take into account your investment objectives, particular needs or financial situation; and should not be construed as advice in any way. The author holds shares in Adriatic Metals (ADT:ASX). |

Archives

September 2023

|

Copyright © Datt Capital 2018

The information on this website is prepared and issued by Datt Capital Pty Ltd (ABN 37 124 330 865 AFSL 542100) (Datt Capital). The information is intended for wholesale clients within the meaning of section 761G or 761GA of the Corporations act 2001 (Cth) (Corporations Act) and must not be made available to any persons that are “retail clients” for the purpose of the Corporations Act.

Datt Capital is the investment manager of The Datt Capital Absolute Return Fund (Fund) which is available to wholesale investors only. Fundhost Limited (ABN 69092 517 087 AFSL 233045) (Fundhost) is the issuer and trustee of the Fund. An investment in the Fund will only be available through a valid application form attached to the information memorandum. Before making any decision to make or hold any investment in the Fund you should consider the information memorandum in full. The information contained on this website or in any email is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation, or which would subject Datt Capital or Fundhost Limited to any registration or other requirement within such jurisdiction or country. Datt Capital may provide general information to help you understand our investment approach. Any financial advice we provide has not considered your personal circumstances and may not be suitable for you. To the extent permitted by law, Datt Capital and Fundhost, their officers, employees, consultants, advisers and authorised representatives, are not liable for any loss or damage arising as a result of any reliance placed on this document. Information has been obtained from sources believed to be reliable, but we do not represent it is accurate or complete, and it should not be relied upon as such. Datt Capital and Fundhost do not guarantee investment performance or distributions, and the value of your investment may rise or fall. Past performance is not an indicator of future performance

The information on this website is prepared and issued by Datt Capital Pty Ltd (ABN 37 124 330 865 AFSL 542100) (Datt Capital). The information is intended for wholesale clients within the meaning of section 761G or 761GA of the Corporations act 2001 (Cth) (Corporations Act) and must not be made available to any persons that are “retail clients” for the purpose of the Corporations Act.

Datt Capital is the investment manager of The Datt Capital Absolute Return Fund (Fund) which is available to wholesale investors only. Fundhost Limited (ABN 69092 517 087 AFSL 233045) (Fundhost) is the issuer and trustee of the Fund. An investment in the Fund will only be available through a valid application form attached to the information memorandum. Before making any decision to make or hold any investment in the Fund you should consider the information memorandum in full. The information contained on this website or in any email is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation, or which would subject Datt Capital or Fundhost Limited to any registration or other requirement within such jurisdiction or country. Datt Capital may provide general information to help you understand our investment approach. Any financial advice we provide has not considered your personal circumstances and may not be suitable for you. To the extent permitted by law, Datt Capital and Fundhost, their officers, employees, consultants, advisers and authorised representatives, are not liable for any loss or damage arising as a result of any reliance placed on this document. Information has been obtained from sources believed to be reliable, but we do not represent it is accurate or complete, and it should not be relied upon as such. Datt Capital and Fundhost do not guarantee investment performance or distributions, and the value of your investment may rise or fall. Past performance is not an indicator of future performance

RSS Feed

RSS Feed