|

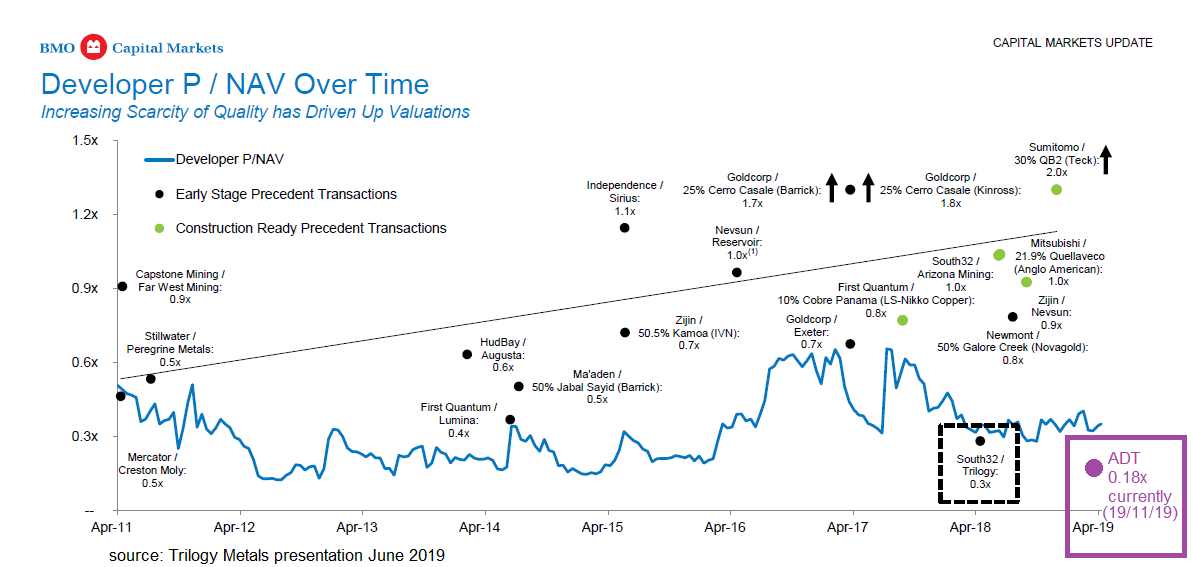

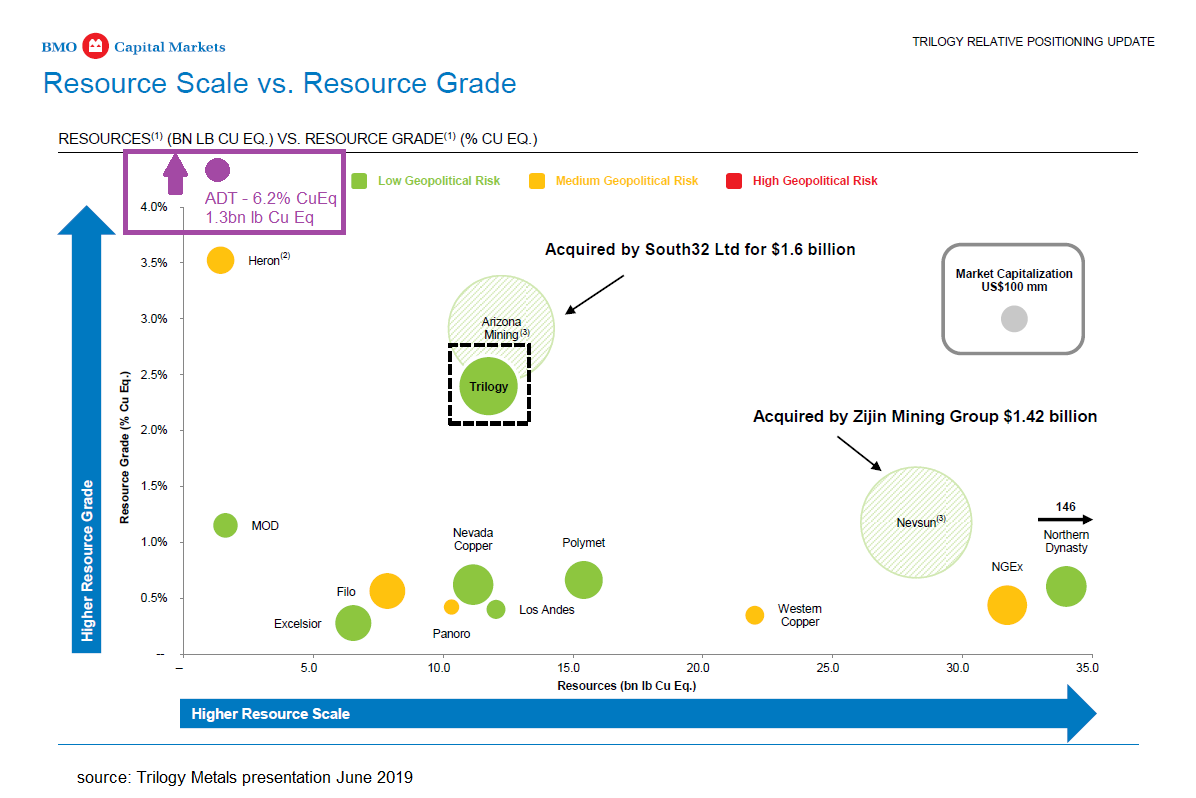

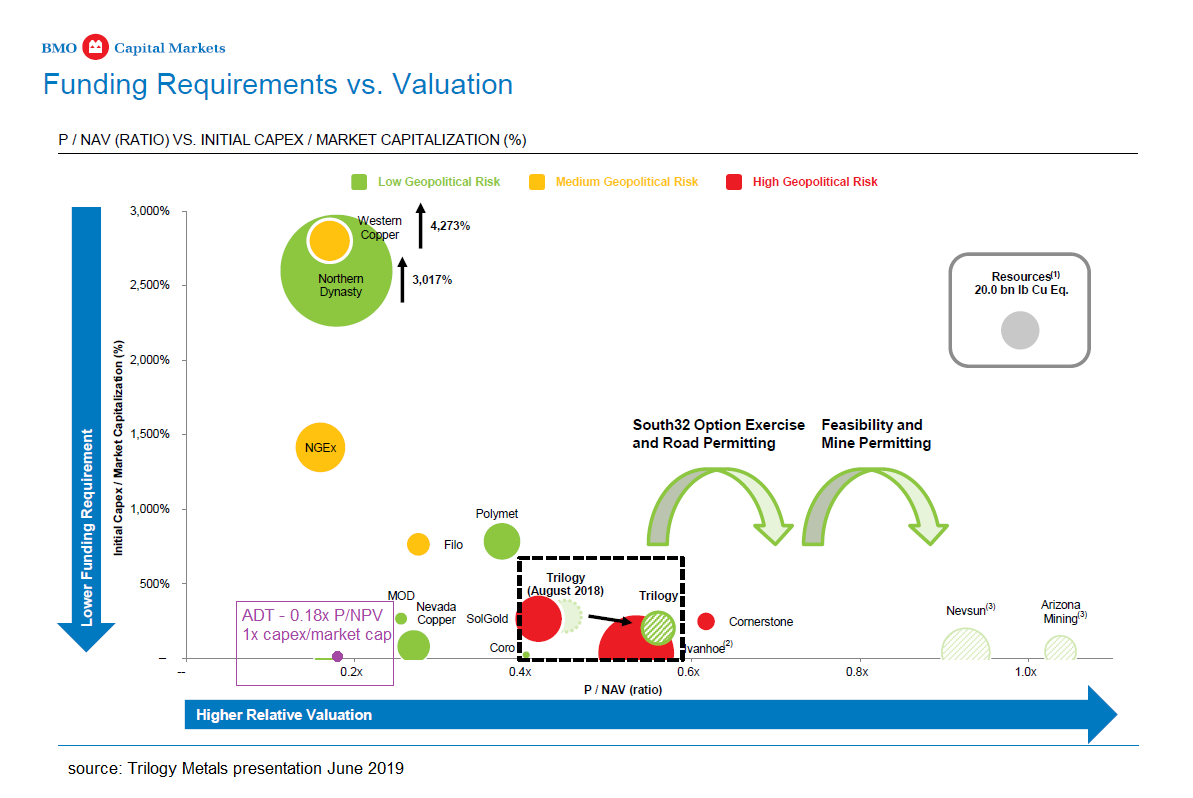

This is an addendum to our investment thesis released on Adriatic Metals ('ADT'). We have been requested by several investors to share our research on similar projects as Vares. We have found that the overall quality of the Rupice deposit has been largely overshadowed by the perception of Bosnia as a mining jurisdiction. We hope this brief comparison will demonstrate the utter uniqueness of the still-growing Rupice deposit relative to other base metal peers. Base metal projects are often converted to copper equivalent (CuEq) to provide a simple method to compare different deposits, especially in the case of polymetallic deposits. ADT has not provided CuEq figures, most likely as the Vares project deposits are copper poor; and have used gold and zinc equivalents (AuEq, ZnEq) as a proxy. We thought it would be beneficial to convert the resource to CuEq just to provide a broad economic comparison relative to other projects. Accordingly, for the Rupice deposit, we come up with an approximate CuEq of ~6.2%. This includes the contribution of barite and takes into account the preliminary met recoveries disclosed by the company. We should note that 'equivalent' grades should never be used solely as the basis for an investment decision by investors, and more detailed analysis should be conducted. The following comparison charts demonstrate how unique and undervalued ADT is relative to comparable base metal projects. It is extremely rare for a resource project to possess an IRR >100%, an NPV above AUD$1 billion and a payback period of less than 12 months. There is a material shortage of commercial base metal development projects available. This is largely due to the exploration decline post-2012 and a continuing skew towards gold relative to base metals in terms of exploration spend. The overall quality of new base metal has fallen dramatically over time, as many high grade and close to the surface deposits have already been discovered.

What's it worth? We examined a peer group of approximately 25 undeveloped resource projects globally and noted the following: Unfinanced projects on average trade at circa 30% of NPV. We believe that ADT should at minimum, trade at the peer group average. Financed projects on average trade at circa 55% of NPV. We believe that ADT should trade at a premium to the peer group average as they advance through the permitting, feasibility and initial financing processes which we believe will occur over the next 12 months. ADT is without a doubt, the standout base metal project in terms of IRR, NPV, capital efficiency, and other economic metrics. What happens now? ADT possesses a unique resource of almost unparalleled quality which drives the projects exceptional potential economic returns along with a very favourable cost jurisdiction. Over the next 12 months, we expect the company to continue to build upon the initial resource at Rupice as well as further explore brownfield and greenfield prospects selectively. We also believe that within this time frame that the company should complete a detailed feasibility study as well as completing the permits required for the mining and processing operations. We should add that any further discoveries or extensions in the project life will only increase already exceptional returns. We also note that the upcoming LSE listing will broaden ADT's investor base and likely provide another potential catalyst for the stock to rerate. Disclaimer: This article does not take into account your investment objectives, particular needs or financial situation; and should not be construed as advice in any way. The author holds shares in ADT. Comments are closed.

|

Archives

September 2023

|

Copyright © Datt Capital 2018

The information on this website is prepared and issued by Datt Capital Pty Ltd (ABN 37 124 330 865 AFSL 542100) (Datt Capital). The information is intended for wholesale clients within the meaning of section 761G or 761GA of the Corporations act 2001 (Cth) (Corporations Act) and must not be made available to any persons that are “retail clients” for the purpose of the Corporations Act.

Datt Capital is the investment manager of The Datt Capital Absolute Return Fund (Fund) which is available to wholesale investors only. Fundhost Limited (ABN 69092 517 087 AFSL 233045) (Fundhost) is the issuer and trustee of the Fund. An investment in the Fund will only be available through a valid application form attached to the information memorandum. Before making any decision to make or hold any investment in the Fund you should consider the information memorandum in full. The information contained on this website or in any email is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation, or which would subject Datt Capital or Fundhost Limited to any registration or other requirement within such jurisdiction or country. Datt Capital may provide general information to help you understand our investment approach. Any financial advice we provide has not considered your personal circumstances and may not be suitable for you. To the extent permitted by law, Datt Capital and Fundhost, their officers, employees, consultants, advisers and authorised representatives, are not liable for any loss or damage arising as a result of any reliance placed on this document. Information has been obtained from sources believed to be reliable, but we do not represent it is accurate or complete, and it should not be relied upon as such. Datt Capital and Fundhost do not guarantee investment performance or distributions, and the value of your investment may rise or fall. Past performance is not an indicator of future performance

The information on this website is prepared and issued by Datt Capital Pty Ltd (ABN 37 124 330 865 AFSL 542100) (Datt Capital). The information is intended for wholesale clients within the meaning of section 761G or 761GA of the Corporations act 2001 (Cth) (Corporations Act) and must not be made available to any persons that are “retail clients” for the purpose of the Corporations Act.

Datt Capital is the investment manager of The Datt Capital Absolute Return Fund (Fund) which is available to wholesale investors only. Fundhost Limited (ABN 69092 517 087 AFSL 233045) (Fundhost) is the issuer and trustee of the Fund. An investment in the Fund will only be available through a valid application form attached to the information memorandum. Before making any decision to make or hold any investment in the Fund you should consider the information memorandum in full. The information contained on this website or in any email is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation, or which would subject Datt Capital or Fundhost Limited to any registration or other requirement within such jurisdiction or country. Datt Capital may provide general information to help you understand our investment approach. Any financial advice we provide has not considered your personal circumstances and may not be suitable for you. To the extent permitted by law, Datt Capital and Fundhost, their officers, employees, consultants, advisers and authorised representatives, are not liable for any loss or damage arising as a result of any reliance placed on this document. Information has been obtained from sources believed to be reliable, but we do not represent it is accurate or complete, and it should not be relied upon as such. Datt Capital and Fundhost do not guarantee investment performance or distributions, and the value of your investment may rise or fall. Past performance is not an indicator of future performance

RSS Feed

RSS Feed