|

Whitehaven Coal reported a record profit result of $2 billion (NPAT) for financial year 2022. EBITDA (Earnings before interest, tax and D&A) rose an astounding 15 times the previous financial year, with a result of $3.1 billion achieved. Free cash flow generated from operations was exceptional at $2.6 billion. This fantastic result was primarily driven by a range of factors including:

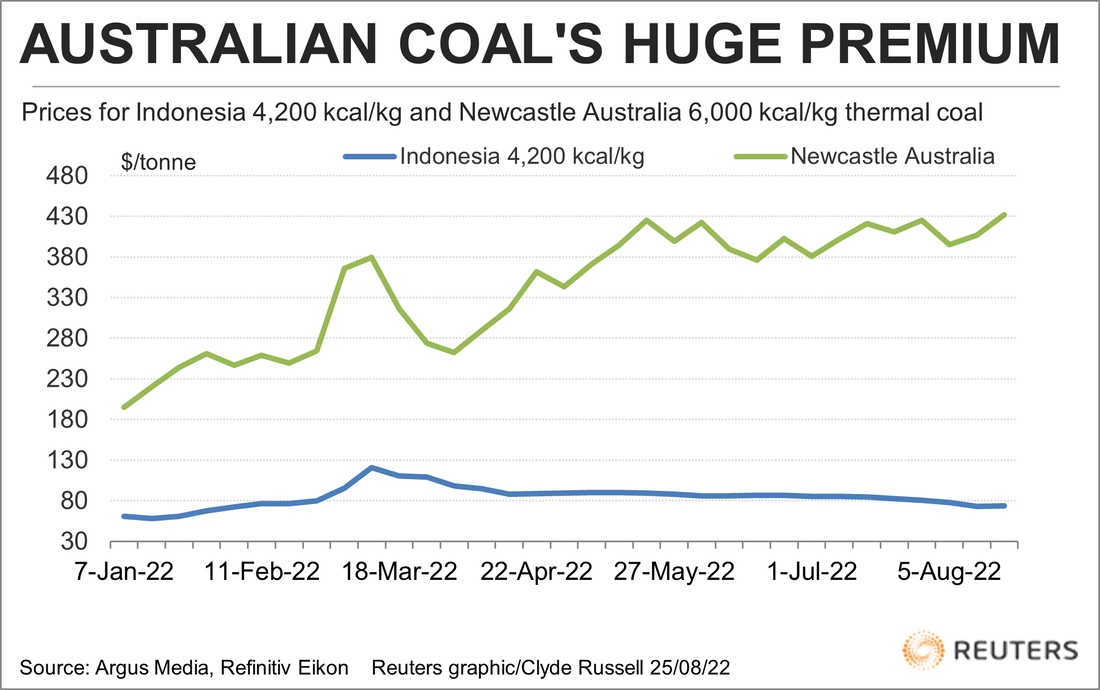

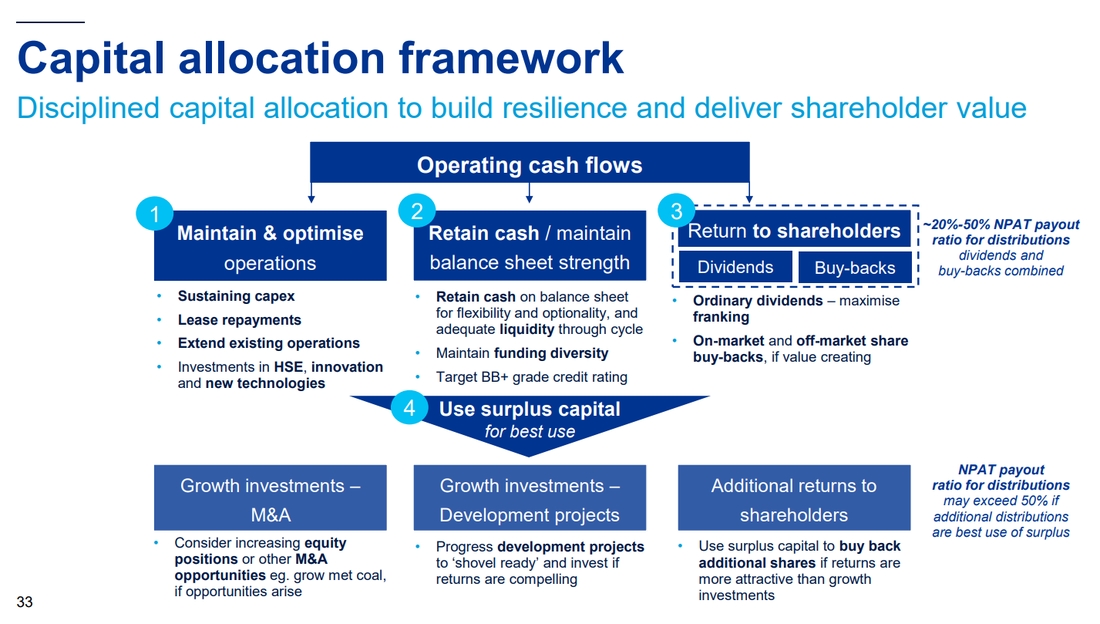

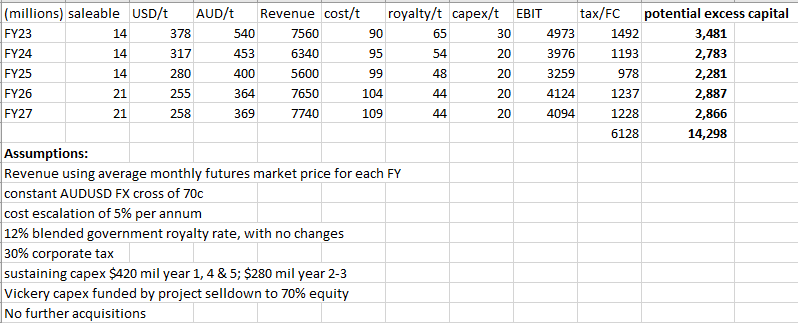

Unequivocally, this has been the standout result from amongst the ASX100, with a Total Shareholder Return (TSR) of 154% achieved for FY22. Importantly, during FY22, the company took advantage of the favourable market conditions to significantly strengthen the balance sheet and reward its shareholders. Specifically, Whitehaven was able to repay $775 million of debt, retiring all long-term liabilities; fully fund its capital expenditure out of its operating cashflow and finally return $1 billion worth of cash to shareholders via fully franked dividends and on-market share buybacks (a small part ongoing). Whitehaven continues to experience exceptionally strong market and business conditions, with spot thermal coal prices (Newcastle specification) at circa AU$600/t versus AU$325/t pricing achieved for FY22. Whitehaven continues to experience demand excess of its supply capabilities due to the high quality and highly-sought after nature of its coal products as well as its enduring relationships with East Asian customers primarily located in Japan & Korea. Any supply response to fulfill demand is unlikely to eventuate for at least 2-3 years, even Whitehaven itself has been unable to lift production given constraints to permitting, labour and the sheer inability to finance new thermal coal developments. Accordingly, existing high quality producers enjoy a significant and likely enduring competitive moat to any potential new entrants; and this is reflected in the spread between low and higher quality coal products. We consider the forward outlook is exceptionally strong, with the ongoing global energy crisis and the peak demand season of the Northern Hemisphere winter mere months away; providing strong upside risk both at company and commodity price levels. Whitehaven have emphasised its commitment to returning capital to shareholders via dividends and share buybacks, and we believe these initiatives will be strongly value accretive for shareholders. We consider WHC's current market valuation, of a mere $7.3 billion, at a (backwards looking) price earnings multiple of only 3.5x to be materially undervalued given the strong outlook for the industry, the quality of the company's assets and the commitment towards aggressively returning excess capital to shareholders. The form in which this excess capital is returned to shareholders is likely to be the key decision at this juncture. The company disclosed a capital allocation framework in their most recent presentation. Most compelling to us is the method of returning capital to shareholders. Whitehaven have highlighted that excess capital may be returned via dividends as well as buybacks (both on and off market). This is structured in such a way that the 20-50% of NPAT will be returned as dividends and buybacks; with excess capital above this being deployed into further buyback if returns are more attractive than growth investments like shovel ready development projects & acquisition prospects. What does this really mean for shareholders? The first exercise we undertake is to attempt to forecast 5 years into the future; we chose this arbitrary number of years because we have transparent price discovery via the futures market. This is despite Whitehaven possessing a production weighted asset life of over 23 years for currently producing assets (ie. not inclusive of development assets). Using monthly futures prices for the next 5 years ahead, we were able to derive the following high-level figures. What this tells us is that within a scenario, using the listed assumptions, brings us to a cumulative, undiscounted excess capital sum of $14.3 billion, along with around $6.1 billion of franking credits at the end of the 5 year term. Do note this is purely on the projected financials and assumes zero terminal value for the remaining life of mine which would be ~18 years on a weighted basis.

The next question that could be asked is: What are the major risk factors with the hypothesis?

The final question is: what is the most effective manner to return capital back to shareholders in the most value-accretive fashion? In my mind, this really comes down to an opinion of what the terminal business *could* be at the end of the 5 years period, as well as the operational performance over this said period. At the present market value of ~$7.5 billion, Whitehaven is valued at around 1.5x projected EBIT for FY23 alone - an unheard of valuation for a high quality, multi-mine, listed and liquid business. Using our 5 year projection, effectively the present market value is approximately half of the projected post-tax cumulative excess capital sum; or only 36% if you include the franking (tax) credits accrued. Accordingly, we believe the Whitehaven should undertake an enormous, aggressive buyback program as opposed to paying out dividends. If the market is unwilling to ascribe a fair value to the company's stock, then the company can recognise and attempt to capture the value differential itself for the benefit of its long-term shareholders. Much of the allure around dividends in Australia stems from the potential distribution of franking (or tax) credits that can be passed through and utilised by the shareholder. With dividends, come other issues such as re-investment risk that are commonly considered by professional investors. However, franking credits can be returned in other manners, such as via an off-market buyback. If franking credits have no been accrued, then an on-market buyback would be the preferred outcome. However, a buyback can be expressed using both methodologies assuming shareholder approval has been obtained. There has been much confusion around the off-market buyback methodology, and we thought it would be useful to demonstrate how it may work in practice. The ATO allows a maximum discount to market of 14% for off-market buybacks, accordingly we have used this figure in our assumptions. On-market stock sale scenario Purchase price - $5 On market sale - $7.80 capital gain - $2.80 Net benefit to shareholder: Sale price only Off-market buyback scenario off-market buyback price - $6.71 (14% discount to market) capital component - $0.50 dividend - $6.21 franking credits - $2.61 Total benefit to selling shareholder - $9.32 - ~19.5% premium to market price inclusive of tax credits, despite discount to market. The off-market buyback methodology is well known on Australian markets, with plenty of precedents. For instance, BHP undertook a $7.3 billion off-market buyback in 2018. In addition, it allows investors to choose whether they wish to partake according to their own tax situation. For example, a foreign investor is unable to claim franking credits, so would be unlikely to partake; however, a retiree may enjoy tax advantages and may gain benefit from the franking credits distributed. In summary, we believe that Whitehaven continues to look undervalued and the company should attempt to return capital aggressively back to shareholders via a combination of on and off-market buybacks as circumstances allow. Disclaimer: This article does not take into account your investment objectives, particular needs or financial situation; and should not be construed as advice in any way. The author holds shares in Whitehaven Coal. Comments are closed.

|

Archives

September 2023

|

Copyright © Datt Capital 2018

The information on this website is prepared and issued by Datt Capital Pty Ltd (ABN 37 124 330 865 AFSL 542100) (Datt Capital). The information is intended for wholesale clients within the meaning of section 761G or 761GA of the Corporations act 2001 (Cth) (Corporations Act) and must not be made available to any persons that are “retail clients” for the purpose of the Corporations Act.

Datt Capital is the investment manager of The Datt Capital Absolute Return Fund (Fund) which is available to wholesale investors only. Fundhost Limited (ABN 69092 517 087 AFSL 233045) (Fundhost) is the issuer and trustee of the Fund. An investment in the Fund will only be available through a valid application form attached to the information memorandum. Before making any decision to make or hold any investment in the Fund you should consider the information memorandum in full. The information contained on this website or in any email is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation, or which would subject Datt Capital or Fundhost Limited to any registration or other requirement within such jurisdiction or country. Datt Capital may provide general information to help you understand our investment approach. Any financial advice we provide has not considered your personal circumstances and may not be suitable for you. To the extent permitted by law, Datt Capital and Fundhost, their officers, employees, consultants, advisers and authorised representatives, are not liable for any loss or damage arising as a result of any reliance placed on this document. Information has been obtained from sources believed to be reliable, but we do not represent it is accurate or complete, and it should not be relied upon as such. Datt Capital and Fundhost do not guarantee investment performance or distributions, and the value of your investment may rise or fall. Past performance is not an indicator of future performance

The information on this website is prepared and issued by Datt Capital Pty Ltd (ABN 37 124 330 865 AFSL 542100) (Datt Capital). The information is intended for wholesale clients within the meaning of section 761G or 761GA of the Corporations act 2001 (Cth) (Corporations Act) and must not be made available to any persons that are “retail clients” for the purpose of the Corporations Act.

Datt Capital is the investment manager of The Datt Capital Absolute Return Fund (Fund) which is available to wholesale investors only. Fundhost Limited (ABN 69092 517 087 AFSL 233045) (Fundhost) is the issuer and trustee of the Fund. An investment in the Fund will only be available through a valid application form attached to the information memorandum. Before making any decision to make or hold any investment in the Fund you should consider the information memorandum in full. The information contained on this website or in any email is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation, or which would subject Datt Capital or Fundhost Limited to any registration or other requirement within such jurisdiction or country. Datt Capital may provide general information to help you understand our investment approach. Any financial advice we provide has not considered your personal circumstances and may not be suitable for you. To the extent permitted by law, Datt Capital and Fundhost, their officers, employees, consultants, advisers and authorised representatives, are not liable for any loss or damage arising as a result of any reliance placed on this document. Information has been obtained from sources believed to be reliable, but we do not represent it is accurate or complete, and it should not be relied upon as such. Datt Capital and Fundhost do not guarantee investment performance or distributions, and the value of your investment may rise or fall. Past performance is not an indicator of future performance

RSS Feed

RSS Feed