|

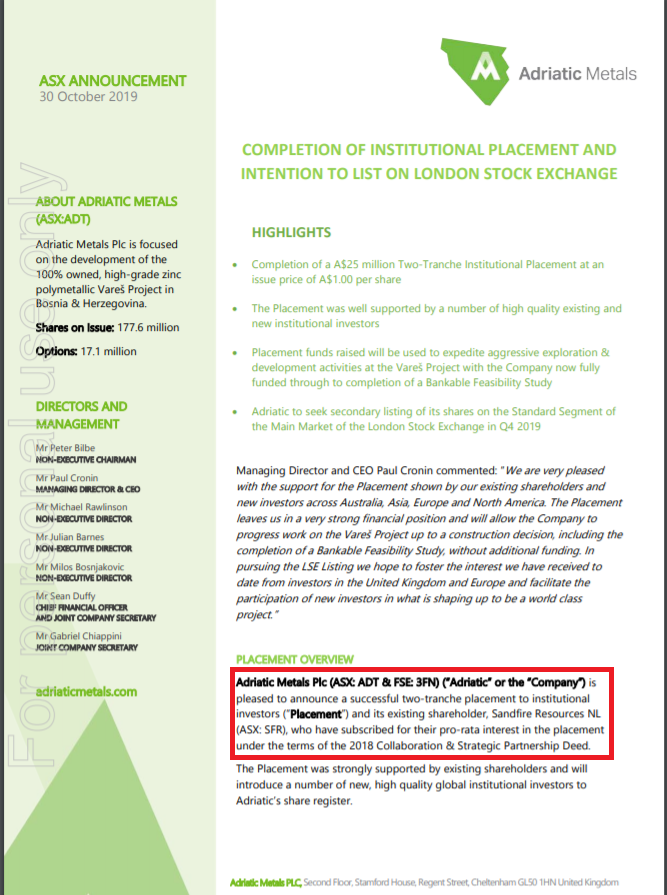

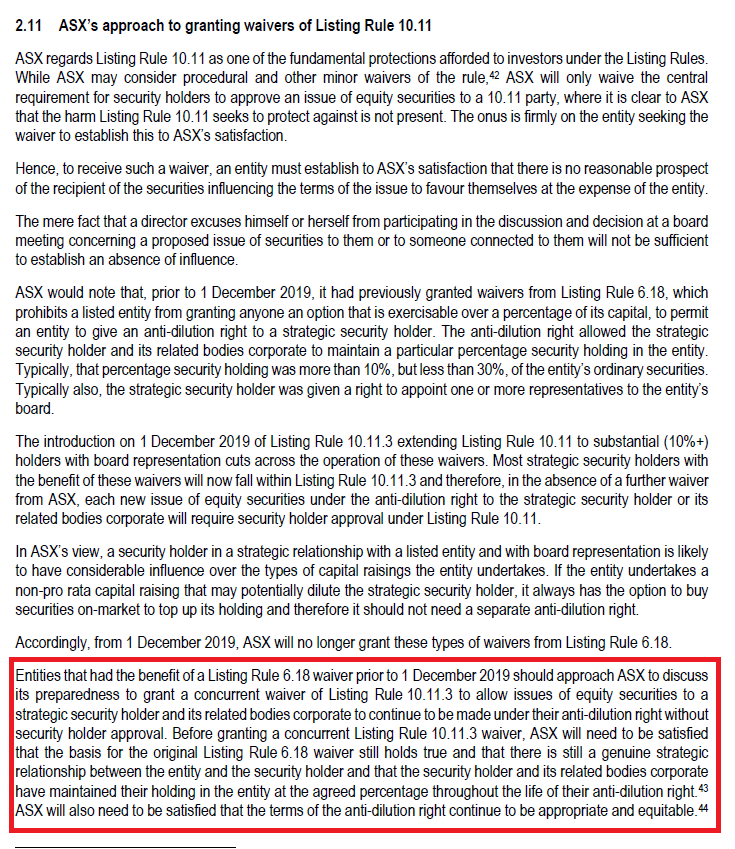

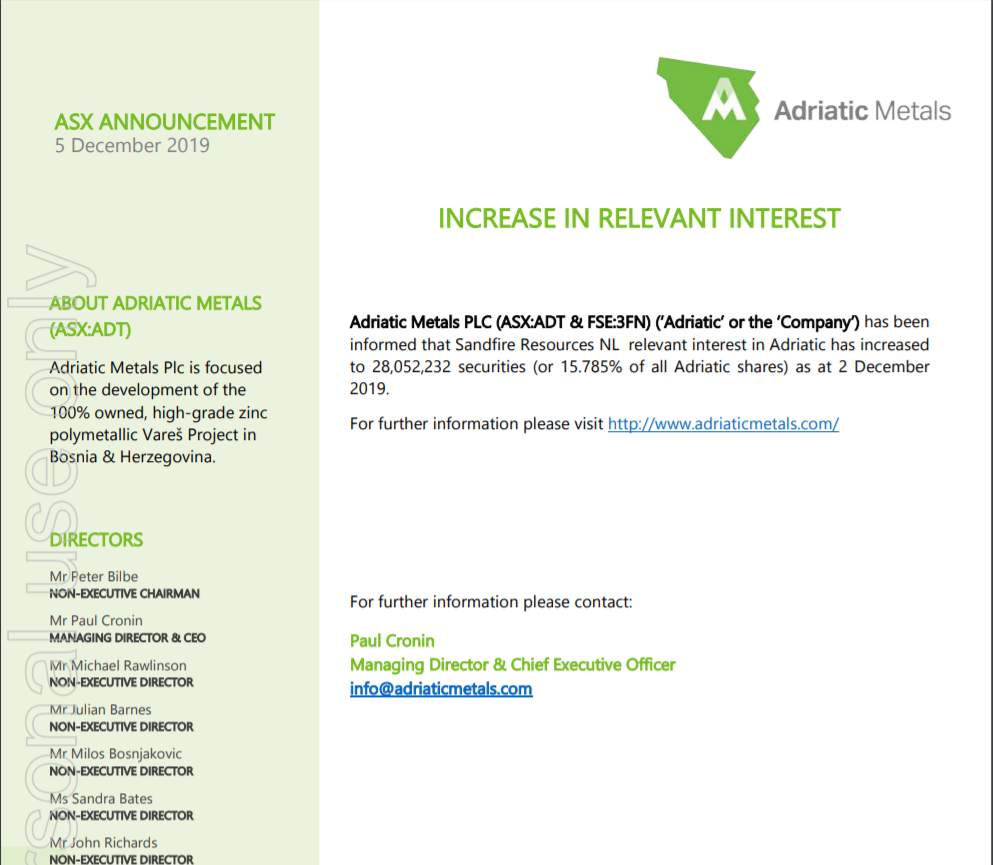

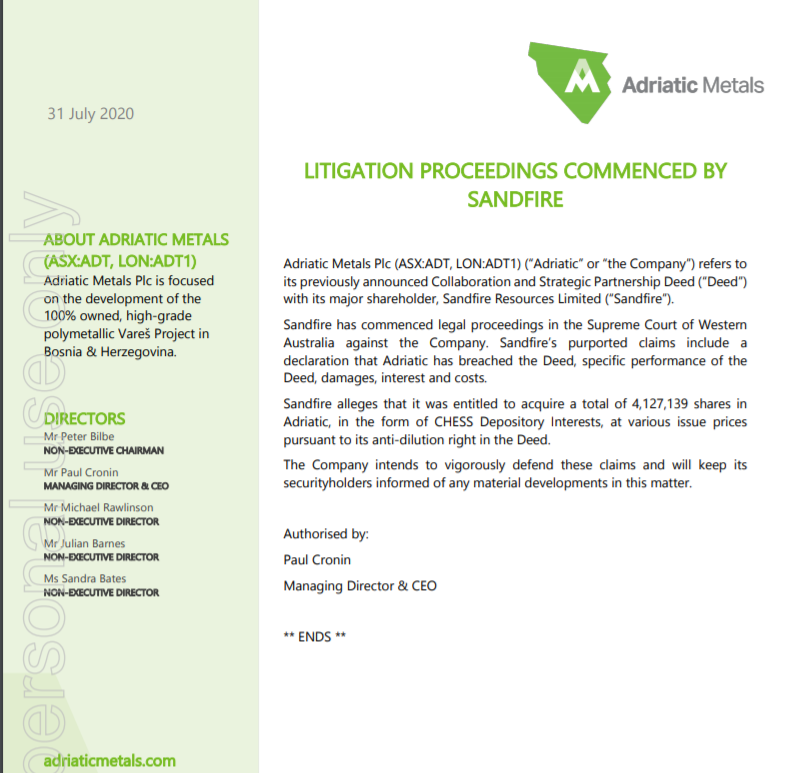

We wrote this piece as a way to share our opinion and thoughts on the evolution of the relationship between Adriatic Metals and Sandfire Resources. This piece is solely opinion and should not be construed as investment advice in anyway. The relationship between Adriatic Metals and Sandfire Resources has been complex. In theory, the relationship should be positive; a junior miner with a world class development project allied and supported by a credible and proven Australian mine builder and operator. In practice, the relationship has seemingly been complicated by the consistent increase of Sandfire's holding in Adriatic and presumably it's influence. We thought it would be an interesting exercise to go through Adriatic's disclosures to observe how the relationship has developed around Sandfire's actions. The relationship began innocuously in May 2018 with both companies seemingly enthused by the strategic and technical expertise offered by Sandfire to assist in progressing Adriatic's projects. Sandfire became the largest shareholder outside the management team as part of this deal and were afforded an anti-dilution right under certain circumstances. The ASX granted a waiver of its listing rule 6.18 under certain conditions in August 2018. Adriatic Metals conducts its first capital raise post listing, raising $10 million with Sandfire participating to maintain its stake in November 2018. Between June and August 2019, Sandfire raises its stake in Adriatic by buying shares on market. It's interest in Adriatic rises from 7.7% to 12.8%. Adriatic conduct their next capital raise of $25 million, with Sandfire subscribing for their pro-rata interest. Sandfire appoint a nominee, John Richards, a respected Australian mining director to Adriatic's board in November 2019. ASX amend their listing rules in December 2019. In particular, the rules around strategic relationships and anti-dilution rights are significantly amended effectively invalidating prior waivers granted. The ASX discloses that its needs to be satisfied that the basis for the original waiver granted still holds true and a genuine strategic relationship still exists between the entities. In addition, the ASX must also need to be satisfied that the terms of the anti-dilution right remain appropriate and equitable to minority shareholders. Notably, the waiver must be initiated by the entity that held the benefit of the anti-dilution right, ie. Sandfire. Source: ASX guidance note 25 Sandfire continue to increase their stake in Adriatic on-market to 15.8%. Sandfire do not disclose the change in interest to the ASX but rather Adriatic disclose the change of Sandfire's interest in December 2019. Sandfire withdraw the nomination of John Richards from the Adriatic board who consequently resigns in July 2020. Sandfire commence litigation against Adriatic, alleging contraventions of the strategic agreement between the two companies in July 2020. This puts Adriatic shareholders in a peculiar position. We have Sandfire, a substantial shareholder of the company, alleging that Adriatic has contravened the strategic agreement between the two companies - without any specific discussion of what particular points of the agreement have been contravened. In addition, Adriatic shareholders can note the increasingly tense language and relationship between the two companies over time which ultimately begets the question - What is Sandfire's ultimate goal?

Ultimately this raises a number of questions for shareholders of both Sandfire and Adriatic, namely: What is the specific basis for Sandfire's claim given that they have participated in every capital raise conducted by Adriatic Metals? Have Sandfire submitted a waiver application to the ASX, given the onus is on the benefiting party to apply for the waiver? If so, has this waiver application been rejected and in what form? Given the litigation has been initiated by Sandfire against Adriatic, has the strategic relationship between the two companies effectively ceased? How long has this been the case for and at what point did it effectively cease? Given that ASX listing rule 10.11 is considered as the fundamental protective clause for minority investors, is it appropriate that this rule is waived to the potential detriment of Adriatic's minority shareholders, especially if the strategic relationship appears to have effectively ceased? Why is Sandfire, a company worth almost $1 billion, fighting over $8 million worth of stock that it is purportedly owed? What was the reason for Sandfire removing their nominee director from the board of Adriatic? Was it to notionally circumvent ASX listing rule 10.11.3 - substantial (10%+) holders with board representation? Why has Sandfire been non-compliant with general ASX requirements regarding substantial shareholder disclosures, especially around December 2019? What is Sandfire's current interest in Adriatic Metals? Is Sandfire's eventual intention to control or takeover Adriatic or Adriatic's projects in some form at some point in the future? Without adequate disclosure of the issues identified above, it is our opinion that the lawsuit brought by Sandfire against Adriatic appears to be frivolous at best. Disclaimer: This article does not take into account your investment objectives, particular needs or financial situation; and should not be construed as advice in any way. The author holds shares in ADT.

Michael

1/8/2020 16:34:20

I would think that their claim is based on the dilution coming from the Thethyan aquisition? Shortly after the aquisition was announced, the Sandfire director was withdrawn. Comments are closed.

|

Archives

September 2023

|

Copyright © Datt Capital 2018

The information on this website is prepared and issued by Datt Capital Pty Ltd (ABN 37 124 330 865 AFSL 542100) (Datt Capital). The information is intended for wholesale clients within the meaning of section 761G or 761GA of the Corporations act 2001 (Cth) (Corporations Act) and must not be made available to any persons that are “retail clients” for the purpose of the Corporations Act.

Datt Capital is the investment manager of The Datt Capital Absolute Return Fund (Fund) which is available to wholesale investors only. Fundhost Limited (ABN 69092 517 087 AFSL 233045) (Fundhost) is the issuer and trustee of the Fund. An investment in the Fund will only be available through a valid application form attached to the information memorandum. Before making any decision to make or hold any investment in the Fund you should consider the information memorandum in full. The information contained on this website or in any email is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation, or which would subject Datt Capital or Fundhost Limited to any registration or other requirement within such jurisdiction or country. Datt Capital may provide general information to help you understand our investment approach. Any financial advice we provide has not considered your personal circumstances and may not be suitable for you. To the extent permitted by law, Datt Capital and Fundhost, their officers, employees, consultants, advisers and authorised representatives, are not liable for any loss or damage arising as a result of any reliance placed on this document. Information has been obtained from sources believed to be reliable, but we do not represent it is accurate or complete, and it should not be relied upon as such. Datt Capital and Fundhost do not guarantee investment performance or distributions, and the value of your investment may rise or fall. Past performance is not an indicator of future performance

The information on this website is prepared and issued by Datt Capital Pty Ltd (ABN 37 124 330 865 AFSL 542100) (Datt Capital). The information is intended for wholesale clients within the meaning of section 761G or 761GA of the Corporations act 2001 (Cth) (Corporations Act) and must not be made available to any persons that are “retail clients” for the purpose of the Corporations Act.

Datt Capital is the investment manager of The Datt Capital Absolute Return Fund (Fund) which is available to wholesale investors only. Fundhost Limited (ABN 69092 517 087 AFSL 233045) (Fundhost) is the issuer and trustee of the Fund. An investment in the Fund will only be available through a valid application form attached to the information memorandum. Before making any decision to make or hold any investment in the Fund you should consider the information memorandum in full. The information contained on this website or in any email is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation, or which would subject Datt Capital or Fundhost Limited to any registration or other requirement within such jurisdiction or country. Datt Capital may provide general information to help you understand our investment approach. Any financial advice we provide has not considered your personal circumstances and may not be suitable for you. To the extent permitted by law, Datt Capital and Fundhost, their officers, employees, consultants, advisers and authorised representatives, are not liable for any loss or damage arising as a result of any reliance placed on this document. Information has been obtained from sources believed to be reliable, but we do not represent it is accurate or complete, and it should not be relied upon as such. Datt Capital and Fundhost do not guarantee investment performance or distributions, and the value of your investment may rise or fall. Past performance is not an indicator of future performance

RSS Feed

RSS Feed