Datt Absolute Return Fund ranked Top 10 Equity Long Only Fund for 2025 by net return. Learn how disciplined portfolio construction and liquidity management supported performance.

~ 2 min. read

By: Datt Capital

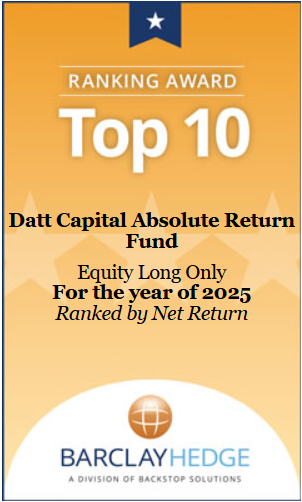

The Datt Capital Absolute Return Fund has been ranked among the Top 10 Equity Long Only funds for 2025, based on net return, by BarclayHedge. This recognition reflects a year where disciplined positioning, capital preservation, and selective opportunity capture mattered more than broad market exposure.

2025 was defined by sharp dispersion across equity markets. Volatility returned. Valuation gaps widened. Liquidity conditions tightened. In this environment, outcomes were increasingly shaped by portfolio construction and risk management rather than index direction.

The Datt Capital Absolute Return Fund is designed for these conditions. The strategy does not rely on rising markets to deliver outcomes. Instead, it focuses on controlling downside risk while selectively participating in opportunities with attractive risk-adjusted returns.

This approach proved effective during a year where many equity strategies struggled to balance return and volatility.

Traditional equity long-only strategies are often exposed to drawdowns when correlations rise and market leadership narrows. Absolute return strategies aim to address this by prioritising outcome-based investing over benchmark tracking.

Key characteristics of the Datt Capital Absolute Return Fund include:

In 2025, these attributes helped the Fund navigate periods of market stress while remaining positioned to act when opportunities emerged.

For investors seeking less volatility, lower drawdowns, and a strategy not tied to market direction, absolute return plays a specific role within a diversified portfolio.

This result reinforces the relevance of outcome-focused investing in periods where equity markets are less forgiving and dispersion increases.

Market conditions continue to evolve, volatility remains elevated and earnings dispersion persists. In this environment, disciplined research, liquidity management, and independent thinking remain central to how the Fund is positioned.

At Datt Capital, a leading investment fund manager in Australia, our objective remains unchanged: protect capital first, deploy selectively and focus on outcomes rather than narratives.

If you want to learn more about the Datt Capital Absolute Return Fund or explore how it fits within a diversified portfolio, visit our Fund page or contact our Head of Distribution, Daniel Liptak, via email at daniel@datt.com.au.